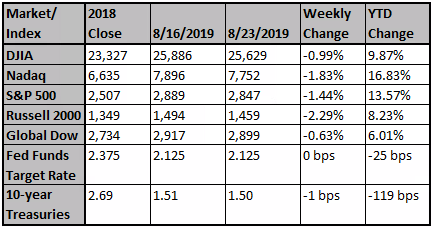

The U.S./China trade war continued to dominate headlines last week as China announced tariffs of 5% to 10% on $75 billion of goods, including autos and oil, effective September 1st and December 1st. The action was in response to President Trump’s previously announced tariffs scheduled for September 1; they may also reflect China’s displeasure over the decision to sell $8 billion of F-16 fighter jets to Taiwan. Markets closed lower for the fourth consecutive week: the Russell 2000® Index declined 2.29% followed by Nasdaq (-1.83%), S&P 500® Index (‑1.44%) and Dow Jones Industrial Average (-0.99%). Friday’s selloff drove interest rates down; the yield curve, which inverted briefly on Thursday and Friday, ended the week with the yield on the 10-year fractionally above the 2-year.

Chairman Powell, in comments on Friday at the annual Federal Reserve Symposium in Jackson Hole, Wyoming, acknowledged that trade disputes are weighing on the economy. He commented, “The three weeks since our July meeting have been eventful. . . Based on our assessment of the implications of these developments, we will act as appropriate to sustain the expansion.” He also observed that there are “no recent precedents to guide any policy response to the current situation. Moreover, while monetary policy is a powerful tool that works to support consumer spending, business investment and public confidence, it cannot provide a settled rulebook for international trade.”

Trade discussions between the U.S. and China remain scheduled for early September despite the escalation in tariffs. Both sides seem frustrated by the lack of an apparent path to resolution. Meanwhile, consumer spending remains the most important catalyst for the domestic economy. Unemployment remains low, wages are improving and consumers benefit from low fuel prices; however, the impasse in trade negotiations may raise fears of a recession which may, in turn, shift consumer sentiment.

The US exported $171 billion of goods and services to China in the four quarters ending in Q1 (the latest data currently available), representing about 7% of total US exports. By contrast, about 12% of US exports went to Mexico, 14% to Canada, and 23% to the European Union. Yes, China is also a key location for production (and, therefore, profits) by US companies, but other areas are capable of picking up much of the slack, including India, Vietnam, and Mexico.

The trade war with China is costly, but unlikely to go global like it did during the Great Depression. Instead, intensifying the trade war with China would make it politically more favorable for the Trump Administration to strengthen trade ties with others, and be more inclined to relieve tariff pressure and threats on other countries. For example, the US announced Sunday that it had an agreement in principle with Japan on a new trade deal that could be signed in September.

Following the upcoming Labor Day holiday, the markets will likely remain focused on the latest trade developments and previews of third quarter earnings announcements. Companies are identifying actions to manage trade-related uncertainties and mitigate the impact of trade wars until conditions improve. These tactics, which may bode well for the equity markets longer-term, will likely prolong market volatility. Analysts were very quick to pin the blame for weakness in stocks late last week on the trade war with China. We agree that uncertainty regarding the future of US-China trade relations was a drag on equities, but think it was far from the only reason for weakness. In fact, it wasn't even the most negative news of the week.

To us, there was also another potentially worrisome bit of news that wasn't at all related the trade issues or the debate about monetary policy, which is a consistent obsession of financial journalists and social media. The Business Roundtable announced that almost all of its CEOs signed a statement saying they were no longer going to run their companies with the primary goal of serving shareholders. Instead, CEOs would lead their companies to benefit all "stakeholders," including "customers, employees, suppliers, communities, and shareholders."

There are some who may view this as an outright rejection of what's come to be known as the Friedman Doctrine, named after free-market icon Milton Friedman, which suggests that a firm's only objective should be to act on behalf of its shareholders. In turn, if shareholders want to use their wealth to pursue pet personal or social causes, they're free to do so themselves with their earnings from corporate profits. "Insofar as a [corporate manager's] actions, in accord with his 'social responsibility,' reduce returns to shareholders, he is spending their money," Friedman wrote.

Those who share this viewpoint might suggest, as an example, that we imagine if Tom Brady and Bill Belichick announced that their primary goal was no longer to win ballgames. Bob Kraft would probably not be happy and the New England Patriots football team might not be worth quite as much after the announcement as it was before. This type of a change introduced uncertainty, and the markets don't like uncertainty. Well, that's part of what we think happened to the stock market last week.

Why do we say this change introduced uncertainty? Because there are examples of companies that may appear to some to have made changes from Friedman's doctrine that may not be so different from Friedman's doctrine. Let's look at Alphabet (Google) as an example. Alphabet is known for its many great employee perks. They provide their employees, among other things, free food, free cooking classes, onsite gyms and workout classes, onsite medical staff, decompression capsules, etc. Following Friedman's doctrine, some could argue all of these many perks are business managers pursuing the personal social interest and agendas. These programs all "cost" the shareholders profitability, and should therefore be done away with. On the other hand, one could argue they are creating very low employee turnover and fiercely loyal employees who will work their hearts out for Alphabet, thereby increasing shareholder value. Those who have studied education may also add Alphabet is helping its employees' brains function at a higher level. Alphabet is a very cutting edge company investing in new ideas; supporting creativity creates shareholder value. Studies have shown there are cognitive benefits to mathematicians and scientists studying music and art. There are studies showing healthier people (right food and enough exercise) are more efficient workers and have higher brain function. Additionally, health studies show that there are also benefits to reduced health care costs when people eat right and exercise. Just as those who strictly follow Friedman may argue all of Alphabet's perks are BAD because they cost the shareholder value, others can argue Alphabet's "agenda" has greatly and richly increased shareholder value.

We believe this change warrants monitoring, and we will observe the actions of corporate America to understand if this is just the new language of maximizing shareholder value or if it is a way for elite corporate managers to drive personal agendas on the shareholders' dime. If this turns out to be a way for elite corporate managers to drive personal agendas at the expense of the business and shareholders, it will prove detrimental to equity values. On the other hand, if this a more holistic view of how to create shareholder value, it could be a great benefit to businesses and shareholder value.

Source: Pacific Global Investment Management Company, Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Latest News

US orders for long-lasting goods rises 2.1% in July

US durable goods orders increase 2.1% in July, investment spending also rises

Asia Markets: Asian markets sink as Trump ratchets up tra...

Asian markets plunged in early trading Monday, as the trade war between the U.S. and China heated up.