As we approach the end of the ninth year of what may be the world's least loved economic recovery, we continue to hear one question repeated, "When do you think it will end?" And with the media publishing articles like this:

- "There's more than a 60% chance of a global recession within the next 18 months, economist says."1

- "This market indicator has predicted the past 7 recessions. Here's where it may be headed next."2

- "Next recession will hit during Trump's first 2 years."3

- "The Stock Market Has Been Magical. It Can't Last."4

- "Any way you look at it, this stock market is overvalued, Goldman Sachs says."5

we completely understand why investors are so focused on this question. Our hope is to answer this question with clarity, simplicity, and factually.

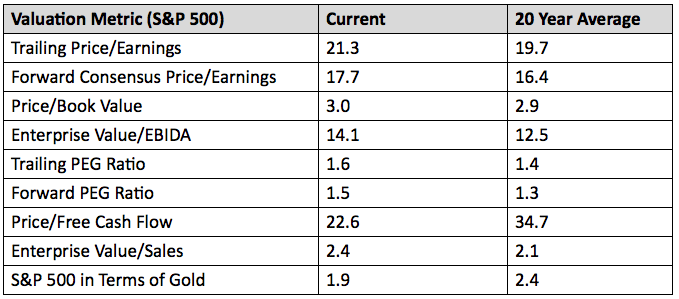

We first will address the question of whether or not the market is OVERVALUED. Below is a list of a number of popular valuation metrics. Don't worry about whether or not you know what they mean, but rather focus on the current measurement and its 20-year average.

* Source: Strategas Analyst Presentations – Tucker's Point

What you can clearly see is that by most metrics, the market is currently valued a LITTLE higher than it historically has been, but not by much. A review of the data shows the market is actually much closer to what is traditionally accepted as a fair market value rather than what the headlines suggest.

Further, in light of the current low interest rate environment, we would argue there is a very rational reason why the markets should be a little above their 20 year averages. One of the primary reasons we think a slightly above average valuation is reasonable is because currently the S&P 500 pays a dividend of about 2%, whereas the 10-year Treasury pays an interest rate of about 2.3%. What the S&P 500 has going for it is over the last 27 years, the S&P 500's average dividend growth rate is 5.87%6; the Treasury's interest growth rate is 0%. Said differently, on a pure income play, the S&P 500 should provide more income over the next decade than the 10-year Treasury will. We would also highlight that earnings have been growing, which should help the S&P 500 advance to higher highs. Beyond these two issues, we also believe there is a chance tax reform may happen, and if it does, that will bring new life (and growth) to U.S. equities. Then there is the issue of inflation; equities are naturally hedged to inflation, and bonds are NOT. If inflation keeps moving along around 2%, we would expect to see a gradual rise in the price of equities due to the inflation. The value of a bond is eroded by inflation.

When it comes to claims of the next recession being imminent, it also seems the pundits fail to recognize that most recessions are preceded by 1) growing inflation, 2) a policy error, 3) and an exogenous event. Inflation has been stubbornly holding near 2% for some time (not growing). Wage growth has also remained softer than many expected (close to 2% - typically, when we see wage growth reach 4%, we know we are nearing the end of an expansion).7 While by definition, the exogenous event tends to be somewhat of a surprise, the fact that we see accelerating and synchronous growth around the world leads us to believe the risk of an exogenous event is perhaps lower than many pundits might predict.

Moving to the actual fundamentals of the U.S. economy, we continue to see many U.S. economic indicators indicating the bull market should continue:

- The S&P 500 Trucking Index contuse to climb.

- Consumer Confidence also appears to hold at above trend levels.

- The Purchasing Managers Index (a manufacturing survey) is in an uptrend.

- The Baltic Dry Index continues to climb from its lows in 2016.

- US Office Rents / Square Foot continue to climb from their lows in 2010.

* Source: Thomson Datastream

The aggregation of all these data points lead us to our cautiously optimistic viewpoint that the markets should continue to advance and the economy should continue to expand. Monitoring the economy's indicators may provide some insight into when the market's will turn; we believe that time is not yet upon us.

If you'd like to have a more detailed, personal portfolio review, please let us know. Your monthly reports are also now posted to your client portal. You can get their by going to www.fortemfin.com and clicking on client login button in the upper right of the webpage.

- https://www.cnbc.com/2017/04/10/theres-more-than-60-chance-of-a-global-recession-within-the-next-18-months-economist-says.html

- https://www.cnbc.com/2017/06/05/inverted-yield-curve-predicting-coming-recession-commentary.html

- http://www.marketwatch.com/story/next-recession-will-hit-during-trumps-first-two-years-2017-05-01

- https://www.nytimes.com/2017/08/19/business/the-stock-market-has-been-magical-it-cant-last.html

- https://www.cnbc.com/2017/07/24/any-way-you-look-at-it-this-stock-market-is-overvalued-goldman.html

- http://www.multpl.com/s-p-500-dividend-growth

- Strategas: Analysts Presentations at Tucker's Point

Categories: Monthly Market Commentary