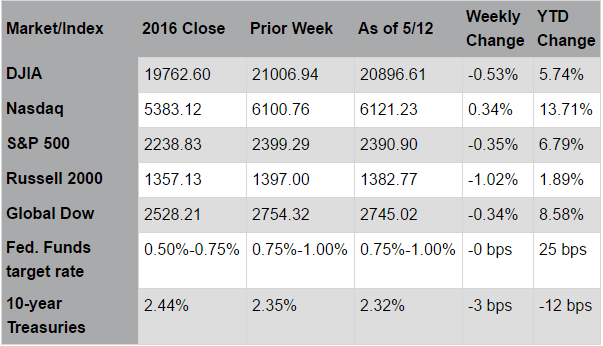

Stocks were mixed-to-down last week as political events dominated headlines. The firing of FBI Director James Comey might have impeded the administration’s tax reform and infrastructure agendas; so far, though, the market’s non-reaction may actually accelerate policymaking timelines as the administration looks ahead. Friday’s announcement of certain trade agreements with China highlighted progress on discussions that began following the President’s meeting last month with Chinese President Xi Jinping. In the deal, China will open its markets to U.S. beef producers and liquefied natural gas; China also agreed to issue guidelines to begin the licensing process for payment processing networks and credit ratings agencies. The deals counter fears of protectionism and suggest President Trump is actively working to lower the trade deficit and expand American business interests. Elsewhere, the European economy is beginning to show signs of life; Germany’s preliminary GDP data for 1Q revealed the economy expanded 1.7% year-over-year. France’s election of centrist Emmanuel Macron should contribute to political cohesiveness and raise prospects for economic reform in the region. Meanwhile, crude oil prices rose for the first time in four weeks; weekly oil inventory reports showed a steeper than expected drop in crude stockpiles as the peak driving season begins. Also, when OPEC meets on May 25th, the cartel is widely expected to extend its production freeze agreement for another six to nine months.

Earnings season is drawing to a close; overall results from more than 90% of companies in the S&P 500® Index include a 14.4% increase in earnings and an 8.7% increase in sales. The results from sectors most responsive to periods of economic growth, such as Industrials and Energy, were particularly strong. This week, ocean-borne container transportation companies highlighted improving shipping volumes amidst a recovery in global trade. Retail sales were also in focus with disappointing updates from Macy’s, Nordstrom, and J.C. Penney. Declining year-over-year sales underscore the pressures facing traditional mall-based retailers; these companies have initiated aggressive cost cutting programs, including store closures, as the industry adjusts to rapidly shifting consumer preferences. Online and off-price retailers, though, continue to prosper in the new retail landscape. Early estimates for the second quarter earnings season anticipate earnings growth of 6.8% and sales growth of 4.8%. The continued positive momentum in corporate results should support equity market valuations. Investors, though, will likely shift their attention to the Federal Reserve’s meeting on June 13-14. Concerns regarding “policy normalization” (i.e., a gradual reduction of the Fed’s expanded bond inventory) could lead to elevated volatility over the ensuing weeks.

News of the consumer's death has traveled fast.

It's not hard to find stories of beleaguered and battle-wearied consumers. Famed retail giants are slashing revenue and earnings outlooks, creating worries about retail space in general and malls in particular. Auto sales are slowing, auto loan delinquencies are rising, while delinquent student loans create their own paroxysms of fear in analyst minds.

But, just as with many negative forecasts over these past eight years, the news of the consumer's death is greatly exaggerated. On average, consumers are in good shape.

The best news for the consumer is that the labor market continues to heal. At 4.4%, the unemployment rate is the lowest since 2007. Some watch what they call the "true" unemployment rate, which includes discouraged workers as well as part-timers who claim they'd prefer full-time jobs – that's 8.6%, also the lowest since 2007. Meanwhile, wages and salaries are up 5.5% in the past year, outstripping inflation.

Meanwhile, consumer debt burdens are down. The Federal Reserve keeps track of the "financial obligations ratio," which measures the share of after-tax income consumers need to meet monthly debt service payments plus regular (non-debt) payments such as renting a home, leasing a car, property taxes, and homeowners' insurance. At 15.4% of after-tax income, these payments are near the lowest since the early 1980s.

Yes, serious (90-days or more) auto loan and student loan delinquencies are at record highs. But serious delinquencies, for all loans – including auto and student loans, plus mortgages, home-equity, credit card, and other consumer debts are down substantially in the past seven years, to $415 billion at the end of 2016 versus $1.04 trillion at the end of 2009.

Don't get us wrong. The rapid and persistent rise in student loan debt is a problem. Some indebted students are finding they must put off borrowing to buy a home, for example. But these loans pay colleges and universities to employ professors and administrators who spend it, meaning it's a transfer payment to the self-described "educator" class.

Unlike a subprime loan that facilitates the building of a home (an asset), the real problem with student loans is they often generate a product that decries wealth creation. But that's true whether they borrow the money they use to pay for college or pay for it out of their own pockets (or their parents').

Yes, after hitting a record high in 2016, at 17.5 million, sales of cars and light trucks appear to be slowing. However, the growth of the driving-age population and scrappage rates suggest underlying demand of about 15.5 million units per year. So, if anything, auto sales were probably artificially strong in 2014-16 as consumers made up for lost time back in 2010-12 when the age of cars on the road had risen after the Panic of 2008. Now, the industry is just gradually returning to normal. In other words, it's not a sign that consumers can't spend.

Nor are we concerned about problems with retail spending. Consumer habits are changing and shifting toward the internet, where sales are booming. When you can shop on-line with your phone or tablet and have products delivered to your doorstep, the economy doesn't need billions more square-feet of retail space. So brick and mortar retailing will continue to grow at a slower pace than GDP, while warehouses will expand.

Source: Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week's Headlines

- Consumer prices increased 0.2% in April following a 0.3% decrease in March, according to the Bureau of Labor Statistics. For the 12 months ended in April, the Consumer Price Index rose 2.2%. The energy index rose 1.1% for the month, while prices increased in shelter, energy, tobacco, and food. However, prices fell in medical care, communications, and apparel. The index less food and energy rose a scant 0.1% in April after declining in March. While better than March, April's price gains are marginal at best and not in line with the Fed's expectations for steady price growth.

- Retail and food services sales in April increased 0.4% from the previous month, and 4.5% above April 2016. Gasoline stations sales were up 12.3% from April 2016, while nonstore retailers were up 11.9% (internet sales) from last year. Excluding automobile and gas, sales are up 0.3% in April over March.

- Wholesale prices climbed in April, as the Producer Price Index advanced 0.5% after edging down 0.1% in March, according to the U.S. Bureau of Labor Statistics. The PPI rose 2.5% for the 12 months ended April 2017 — the largest increase since moving up 2.8% for the 12 months ended February 2012. Almost two-thirds of the April advance in the index is attributable to prices for services, which moved up 0.4%. Prices for goods climbed 0.5%. Prices less foods, energy, and trade services increased 0.7% for the month and are up 2.1% for the 12 months ended in April.

- Not unexpectedly, the number of job openings was little changed at 5.743 million on the last day of March, according to the Job Openings and Labor Turnover (JOLTS) report. The number of openings exceeded the number of hires (5.260 million) by about 483,000. Over the month, hires and separations were also little changed at 5.3 million and 5.1 million, respectively. The job openings rate remained at 3.8% for the month. There were 5.1 million total separations in March, little changed from February. Over the 12 months ended in March, hires totaled 62.9 million and separations totaled 60.5 million, yielding a net employment gain of 2.3 million.

- The price index for U.S. imports advanced 0.5% in April after ticking up 0.1% the previous month, the Bureau of Labor Statistics reported. Export prices rose 0.2% in April following a 0.1% advance in March. Export prices have not recorded a monthly decline since the index fell 0.8% in August 2016. Prices for exports rose 3.0% over the past 12 months. The increase in export prices was driven by both agricultural and nonagricultural (e.g., automobiles, foods, feeds, and beverages) price increases. Import prices rose 0.5% in April and have not recorded a monthly decline since the index edged down 0.1% in November. Prices for imports rose 4.1% for the 12 months ended in April. Import prices were boosted by a 1.6% increase in fuel prices in April.

- According to the Treasury Department, the federal government realized a surplus of $182 billion in April — $76 billion more than the surplus in April 2016. Receipts in April were $455 billion, while total spending was $273 billion — $59 billion less than spending in April 2016. The budget deficit in March was $176 billion. For fiscal 2017, which began in October 2016, the federal budget deficit was $344 billion — $8 billion less than the shortfall recorded during the same span last year, largely due to the timing of certain payments. If not for those shifts in payments, the deficit for the first seven months of fiscal 2017 would be $77 billion larger than the one recorded for the same period last year.

- In the week ended May 6, the advance figure for seasonally adjusted initial claims was 236,000, a decrease of 3,000 from the previous week's unrevised level of 238,000. The advance seasonally adjusted insured unemployment rate remained at 1.4% for the fourth consecutive week. The advance number for seasonally adjusted insured unemployment during the week ended April 29 was 1,918,000, a decrease of 61,000 from the previous week's level, which was revised up 15,000. This is the lowest level for insured unemployment since November 5, 1988, when it was 1,898,000.

Eye on the Week Ahead

This week is a slow one for important economic reports. Investors will be watching for more corporate earnings information, while also tracking the EU following France's presidential election and Puerto Rico's continuing debt crisis.