The first quarter of 2022 is slowing. There’s a clear shock to demand (eg, closures for schools, flights, cruises, etc). U.S. initial jobless claims rose to 286,000 in the Jan 15th week, with existing home sales dipping -4.6% m/m in Dec. However, not all the U.S. data were negative, with the Philly Fed index rising to 23.2 in Jan (offsetting the plunge in the NY Fed manufacturing index earlier in the week). Housing starts rose month over month in Dec and the NAHB housing market index remained elevated in Jan.

If the latest virus variant wave is quick up/quick down (as the S. Africa and U.K. examples indicate), then we don’t want to over-react to the hit to demand.

Instead, we are more focused on whether global supply shocks linger. As we’ve noted previously, U.S. wages have been rising & businesses are worried about inflation. If companies believe demand overall remains strong enough to push through price increases, inflation is likely to remain sticky.

The most important data points we’re watching now are 1) China production (manufacturing PMI) and 2) U.S. wages (the Employment Cost Index or ECI).

Even with China exports running full tilt in 2021, there were bottlenecks due to 1) goods >> services purchases and 2) a large number of excess U.S. retirements. The latter is how we get to full employment with “missing” payroll jobs.

4 key global bottlenecks have been: 1) product, 2) transport, 3) labor, 4) energy. Pre-omicron, the first of these 3 looked to be easing (eg, supplier delivery time measures improving). The China manufacturing PMI should give us some indication on whether there will be another shock in 2022. So far, this looks manageable, but we are not at the finish line yet.

A key difference for 2022 vs. 2021 is that the Fed has lost patience (“transitory” inflation has been retired). So, the tight U.S. labor market matters (eg, elevated job openings & quits). Wages have already started rising based on the ECI. Fed rate hikes should start in March in our opinion. Quantitative Tightening (QT) should follow soon thereafter. A further rise in the ECI would tempt the Fed to get more aggressive.

Bottom line: given the cash cushion that’s been accumulated, we remain much more worried about supply shocks in 2022 than demand shocks. The Fed will likely need help from the private sector, to have inflation moderate successfully. China’s zero-Covid approach (redefined as local “dynamic clearing”) still presents risks for global supply-chain disruptions in the near-term. We don’t want to see key central banks like the Fed spooked into a more aggressive tightening posture.

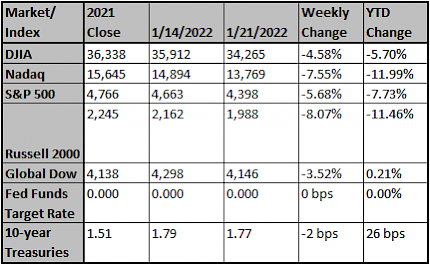

Worst Week For Equities Since March 2020

The sell-off in equities last week was the worst weekly performance for the S&P 500 since March of 2020 when the global economy was shutting down. Today, the environment is much different, abundant central bank liquidity is set to be pulled back, fiscal spending will slow, and inflation is running hot. Sentiment is shifting at least in the near term to a more risk-off approach.

Week One Of Earnings Season Was Very Underwhelming

After the first week of earnings, the aggregate fundamentals saw little improvement. Estimated earnings growth improved to 23.7% from 23.1% and estimated sales growth increased by just 0.2%. While these figures were slight improvements, it’s significantly less improvement than we’ve seen over the last year.

Percentage Of Companies Beating Estimates Lowest Since 1Q’20

Of course it’s still early, but the percentage of companies beating estimates is at the lowest level since the first quarter of 2020 when it was 65%. At 77%, the fourth quarter is still above the longer-term average of 66%. Furthermore, the surprise ratio has shrunk this quarter to 5.9%.

2022 FAAMG Net Income Growth To Be Less Than Aggregate S&P 500

While we have written about the risk associated with the S&P 500 due to the concentration at the top, we noticed the fundamental case is beginning to point towards caution too. For 2022, net income growth for FAAMG is expected to be 7.7%, a full percentage point lower than the overall index. FB, AAPL, & GOOGL are estimated to have net income growth of 1.2%, 5.0%, and 5.6% respectively, while AMZN and MSFT are estimated to have net income growth of 20.0% and 12.5%.

ACTIVE MANAGEMENT COULD BE ONE WINNER FROM HIGHER INFLATION

While quantitative easing has been a boon for financial and real assets alike since it was first introduced in November 2008, it has been a very difficult period for active management. HFRI’s Long/Short Index has underperformed the S&P 500 for 13 consecutive years since 2009, while the relative performance of actively managed large-cap funds has steadily declined over the same period. One potential reason why this has been so, in our view, has been an “everyone gets a trophy” cost of capital that has kept weak corporate players alive. Generally speaking, financial analysts and portfolio managers are not trained to buy unprofitable companies. Some have an interest in shorting them. Free money makes such an endeavor difficult, if not outright dangerous. The ranks of companies not earning a profit in the prior 12 months have skyrocketed among a number of American stock indices. Quantitative tightening and the potential for higher and more variable interest rates that might accompany it has the potential to change this dynamic over time. Higher inflation will be a profits-tailwind for high-quality companies that can maintain pricing power, but it is also likely to depress the multiples investors are willing to pay for earnings.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Analysis: Crisis in Ukraine a showdown of two world views

The crisis in Ukraine is here to stay, and it has the potential to upend Europe. The post Analysis: Crisis in Ukraine a showdown of two world views appeared first on Boston.com.

Boston Globe

Economy Week Ahead: Fed, GDP, Consumer Spending

The Federal Reserve is likely to strengthen expectations of rate increases this year.

The Wall Street Journal

Rapid rise in mortgage rates startles homebuyers, who bla...

All the big unknowns surrounding the rapid jump in inflation including how high consumer prices will go and how quickly the Fed will raise interest rates have put the mortgage market on h...

USA TODAY