Increased Market volatility absolutely has to do with inflation and all eyes are looking on how the Fed can catch up from recent mistakes. It has been claimed that the first casualty in any war is the truth. In the fullness of time, historians of future generations will be charged with determining whether this maxim was accurate when it came to the all-out war waged by policymakers against COVID-19. Certainly, in addition to the tragic loss of life due to the virus, there have been other public casualties, not the least of which has been a weakening of our social fabric and deepening distrust of once-venerated institutions. We take at face value the idea that policymakers have been acting with good intentions and in good faith. Still, public trust requires both proper motivation and competence. We fear that the hyper partisan nature of our current national discourse in the context of higher inflation will make it difficult, in the end, for the Fed to retain its political independence, risking the worst of both worlds – lower asset prices and persistently high inflation.

No further ink needs to be spilled on these pages about how our central bank absolutely whiffed on the idea that the inflation we started to see last year was transitory. Thankfully, there is little doubt now that both the Administration and the Fed recognize the need to tighten monetary policy to address the potential for persistently high inflation. The question now is the pace and the manner in which such tightening can and will occur. To the extent to which lags in policy are long and variable, we are skeptical that the current inflationary pressures in wages and rents will subside quickly or on their own. Our environmental policies and goals are similarly likely to continue to drive up the prices of oil and industrial metals without a change in course. A resolution of supply chain issues will no doubt bring down the rate of inflation on some goods, like autos, but it is difficult to see a 36% increase in the level of M2 in a two-year period not having a long-lasting impact on the general price level.

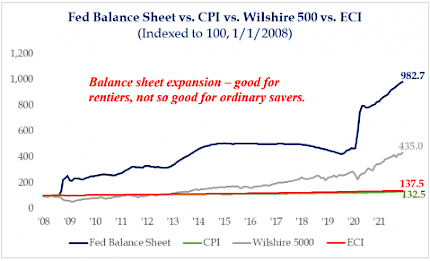

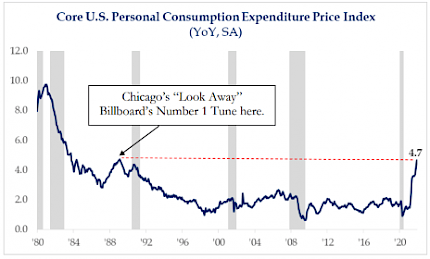

Compounding these problems is the fact that the Fed - if you can believe it - is still easing. According to the New York Fed’s schedule, the central bank is poised to purchase another $40 billion in Treasury securities over the next four weeks. It is difficult to view this as anything other than a policy mistake to the extent to which CPI is running at 7%, core PCE at 4.7%, and the ECI at 3.7%. (The core PCE is the Fed’s favored measure and is now at a level last seen in 1988.) Strategas research Chief Economist, Don Rissmiller, and Fixed Income Strategist Tom Tzitzouris believe there will be four rate hikes in 2022. What’s more, they believe that the Fed will employ quantitative tightening, a passive attempt to reduce the amount of assets on the Fed’s balance sheet by allowing debt securities to mature. In today’s world, the tool for increasing the Fed Funds rate is the interest the central bank pays on excess reserves (in Fed circles IORB). The Fed can raise the interbank rate in a matter of seconds with a few keystrokes. It is very public and easy-to-understand method of tightening. It will also increase the interest rate we all receive on our savings. More opaque, at least to the casual observer, will be the management of the balance sheet.

One need only consider the fact that a sitting Senator called Jerome Powell “a dangerous man” to understand the perceived political stakes of changes in monetary policy. (I would like to invite the good Senator to take a trip to midtown Manhattan for a better understanding of just what the word “dangerous” really means.) What worries us is that the current political environment may prompt the Fed to focus more on balance sheet control than increases in interest rates. While this may seem like an overly technical matter, we fear that the policy could have the dually unintended effect of immediately lowering asset prices while more slowly fighting the inflation in goods and services that hurt middle-class savers. It might make some people feel better to see the rich get poorer, but it is unlikely to help those living paycheck to paycheck.

One of the great ironies of the introduction and continued use of quantitative easing after the Global Financial Crisis is that it was far more beneficial for wealthy people who held financial assets than it was for the middle class who might only have savings. They received no rewards for their thrift while the rentier and speculative class became ever-richer. Mercifully, inflation in goods and services was relatively tame during the period. Currently, it seems as if the bill is coming due for our bipartisan fiscal profligacy and an excessively accommodative monetary policy regime. For the equity investor, we believe this will continue to lead to an underperformance of stocks trading at a multiple of sales and an outperformance of companies leveraged to inflation and higher interest rates in the Energy, Basic Materials, and Financials sectors.

In times of stress and uncertainty, I often turn to economic history for guidance. In the last three weeks, I have re-read William Silber’s biography of Paul Volcker (Volcker: The Triumph of Persistence) and read, for the first time, Robert Samuelson’s The Great Inflation and Its Aftermath. If there is one thing that stands out from these accounts, it is how difficult it is to bring inflation under control once expectations for higher prices become entrenched. Another point worth noting is how slow real long-term interest rates were to respond to real progress on inflation in the early 1980s. It seems that trust, once lost, takes a long time to restore. Long-term interest rates are still low and our inflation is still relatively new. Balance sheet run-off may be a politically expedient way to fight inflation but it may be too slow. Bold and decisive Fed action may allow us to avoid long-lasting pain and suffering. Half-measures may only serve to prolong them.

Source: Jason De Sena Trennert at Strategas

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com