We came across an interesting article from one of our research providers this week and thought we would share it with you. This piece makes an interesting argument for why commodities and materials may be among the better performing investments for the next few years. Although so much of the media’s coverage these days seems to focus on social unrest or geopolitical conflict, there are still nuggets of information that may help identify investment opportunities.

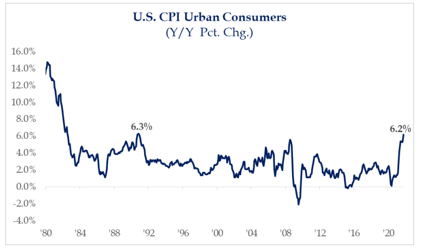

Since the start of quantitative easing in response to the Global Financial Crisis (GFC) in 2009, accommodative monetary policy has been used as a kind of Swiss Army Knife for public policy – relied upon to fix a variety of issues, from social justice to rising sea levels, for which it is at best ill-equipped, and at worst, useless. Add in unrestrained government deficit spending to deal with a global pandemic and regulatory policies in the United States and Europe that make it more difficult to access and transport the sources of energy upon which the global economy is so currently dependent, and it should be of little surprise that the CPI (Inflation) has been running at levels of greater than 5% for five months. Like it or not, the word transitory started out as a forecast, then became a hope, and now looks to be a punchline.

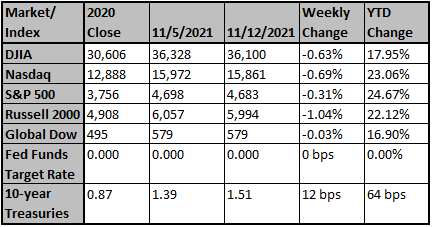

A 25% increase in the S&P 500 and a 10-year Treasury yield of 1.5% can hide a multitude of sins and allow those in charge to double down on policies that risk structurally high levels of inflation. Some bottlenecks and supply chain issues are undoubtedly sources of higher prices and will, with the passage of time, work themselves out. Nevertheless, once started, expansionary fiscal and monetary policies are very hard to stop without economic pain. Like the Hotel California, you can check out any time you want, but you can never really leave. This is especially true if one considers the fact that China is unlikely to be as large a source of disinflation in the future as it was in the past, that there appears to be a structural change in the number of adults who can or want to participate in the workforce, and environmental goals that will increase the cost of doing business and also likely drive up the price of a variety of commodities.

The seemingly unlimited “creation” of money, unrestrained “free trade” with large economies that fix their own currencies, and negative interest rates have all had an impact on inflation. This combined with the concerted focus on climate change regardless of its immediate financial cost give us reason the believe additional inflationary pressure seems to be the most likely outcome.

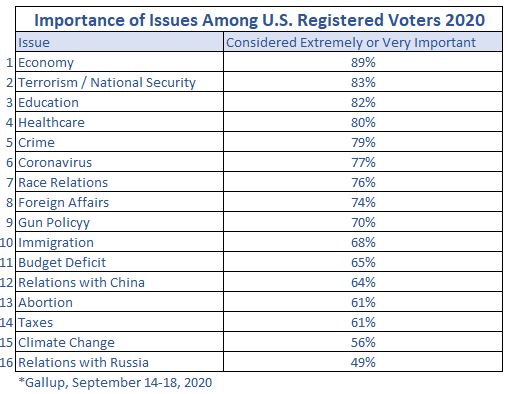

Further, when we look at the list of issues important to registered voters in 2020 (See Gallup Poll below), it seems that the government will continue to increase its spending. The government’s solution to each of the top six concerns among American voters is to “spend more.” Further, there is a strong push in Biden’s administration to significantly increase spending to address climate change (item #15 on the list below).

What is important for those of us who ply our trade in the financial markets is to determine how we believe it is best to invest in this environment. What we have observed is that politicians are committed to policies that appear to be creating a current shortage of fossil fuels and greater-than-usual demand for industrial commodities like copper, lithium, cobalt, and manganese.

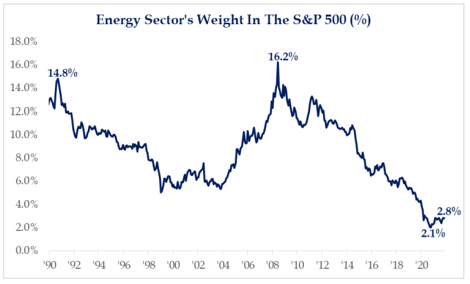

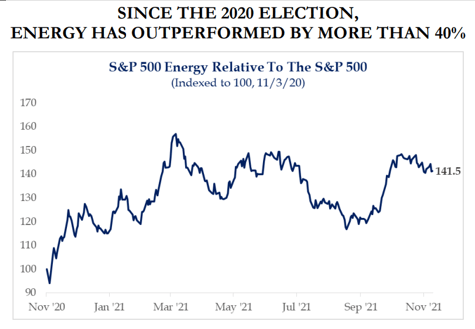

Year-to-date, this has translated into exceptional performance for both commodities and stocks. The S&P Energy sector has greatly outperformed the broader Index, up + 58.3% this year, while the S&P Materials sector, up +25.0%, has provided returns in line with the market in a good year.

There is a certain irony in this. President Trump loved the energy sector and stated publicly at the start of his Administration that he wanted the U.S. to be a net exporter of fossil fuels. Sadly, for investors in the sector, the Administration fed into the worst instincts of those who run energy companies from a capital allocation perspective. Returns reflected this lack of discipline. President Biden, on the other hand, immediately ordered a pause on all oil and gas leasing on federal lands and killed the Keystone pipeline. Energy stocks have never looked back.

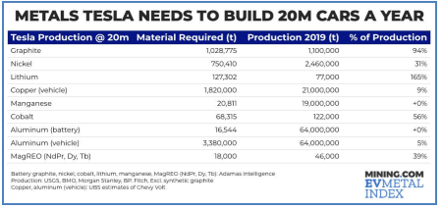

Also ironic is the near pathological obsession with electric vehicles. As the chart below shows, the EV industry is extraordinarily dependent upon a variety of commodities whose extractive processes could hardly be described as “green.” The growing power of the ESG movement to influence capital allocation decisions at “dirty” companies has had the perverse impact of making them far better investments.

To the extent to which the world leaders remain committed to the rapid adoption of renewable energy sources, investors are likely to be presented with opportunities in relatively small and cheap sectors within the S&P 500 (Energy 3% and Basic Materials 2%) over the next several years. One can’t help but wonder whether the rapid adoption of renewable energy sources would be possible with low oil prices; we are inclined to think not. Unfortunately, oil at $50 a barrel is unlikely to cut it, so we believe its price will remain elevated well into 2022 and 2023.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by FactSet.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

'Check Your Inbox:' $2 Billion In Student Loan Forgivenes...

The Biden administration is in the process of cancelling $2 billion in student loans for 30,000 borrowers. "Check your inboxes!" said Secretary of Education Miguel Cardona in a tweet last...

Forbes

Roads, transit, internet: What's in the infrastructure plan

The $1 trillion public-works plan that President Joe Biden signed into law Monday has money for roads, bridges, ports, rail transit, safe water, the power grid, broadband internet and more

ABC News

October retail sales are expected to be strong, showing e...

Economists predict October retail sales rose 1.5%, benefiting from higher fuel costs and early holiday shopping.

CNBC