Amazon, Berkshire Hathaway, and JPMorgan Chase, three of America?s largest companies, announced plans today to start a separate, non-profit company with the goal of improving health care for their U.S. employees. Warren Buffett said in a statement that the three companies do "not come to this problem with answers. But we also do not accept it as inevitable.? This announcement, albeit with vague details, caused shares of companies across the health care industry, from health insurers, to distribu… View More

January 2018

Post 1 to 7 of 7

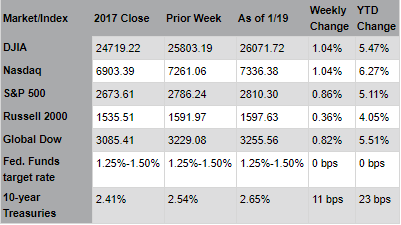

The market rally continued last week with the end of the government shutdown on Monday and as strong corporate earnings and economic data recharged bullish sentiment. All of the major indices closed at record highs; yet, investors continued to favor large cap stocks over smaller company shares. Treasury yields stabilized after rising by roughly 0.25% year-to-date. One might describe these conditions as a ?Goldilocks? environment: the rate of economic growth is sufficient to support risi… View More

Government Shut Down averted for the time being, Earnings and Tax Plan are driving the economy and financial markets

Stocks rose during a volatile week last week as concerns over a potential government shutdown and rising interest rates weighed on investor sentiment. Investors have temporarily retreated from riskier areas of the market: sectors that had been performing well over the past few weeks, such as Energy and Industrials, lagged while Consumer Staples (including food, beverages, and household products), Health Care, and Technology outperformed. Also, large cap stocks outpaced small caps. The gov… View More

Markets continued their strong start to the New Year with another 500+ point advance in the Dow Jones Industrial Average last week breaking through DOW 26k today. Improving fundamentals for the global economy, and corporations, are buoying investor confidence; weekly inflows into global equity markets hit a six-month high. Small cap value stocks outpaced large cap growth stocks; the market?s preference for small caps indicates that investors are starting to look for returns outside of popu… View More

2017 was a great year for the markets and the overall economy. Looking forward to what we may expect in 2018, the data so far seems to suggest there is still room for the economy (and markets) to continue their expansion. Some of the things we are watching are: Since congress passed the tax bill, 85 (and counting) US companies have announced new bonuses for their employees or that they are increasing their employees’ benefits The New York Fed’s underlying inflation gauge stands at 2.95… View More

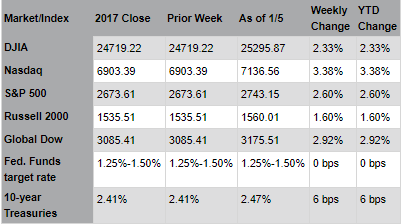

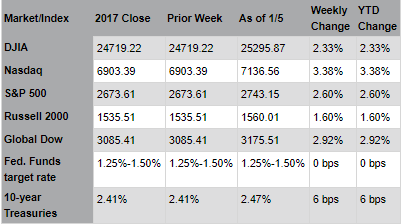

As the New Year begins, investors are beginning to assess the impact of tax reform on corporate earnings and growth estimates.The IRS will issue guidance in mid-January which will allow for worker paychecks to be adjusted for lower taxes (and higher take-home pay) by February. This is akin to giving nearly every worker in America a raise at the same time. The last time paychecks adjusted for lower taxes in 2003 growth and yields surged. Additionally, nearly 80 companies have publicly announced i… View More

New Year's is a time many of us reflect on our lives, set new goals, and pursue new opportunities. We hope your 2018 is your best year yet! If you or anyone close to you is looking to evaluate new financial goals or reevaluate older financial goals, Fortem Financial is here to help. 2017 was an outstanding year for stocks; the S&P 500? Index delivered gains in eleven out of twelve months, a feat previously accomplished only in 1958 and 2006. Investors seemed un-phased by … View More