Ever since the stock market bottomed in 2009 during the financial crisis, people have been coming up with reasons why the bull market was about to end. We heard every reason – Brexit, the end of Quantitative Easing, too much debt, COVID, etc. – and while we understood each may be a cause for consternation, we focused on valuations, which suggested the bull market would continue. Over time, math wins.

After the recovery in stocks from the 2020 lockdowns (and especially the latest surge in equity values), some analysts have been saying the US stock market is in a bubble, maybe even like the one it reached in March 2000. Some buttress this claim with the so-called "Warren Buffett Model," which says the market could be overvalued when total stock market capitalization exceeds GDP, like it does now.

Meanwhile, others are convinced that the social media fueled jump in some very small stocks (like Gamestop) and commodities (like silver) signal a building bubble.

But a bubble this is not. At least not yet. The Buffett Indicator is not reliable, the Reddit-fueled burst in some stock prices is very narrow, and signals more of a change in the investing market than any serious sign of fundamental issues.

The bull market still has further to run, and we stand by our year-end projection for the S&P 500 of 4200.

The Federal Reserve has the US economy awash in liquidity, with the M2 measure of the money supply up 25% from a year ago. Another very large fiscal "stimulus" package is wending its way through Congress and is likely to hit the President's desk relatively soon. Some question if the new “American Relief Package” is even necessary?

As Covid lockdowns have been coming to an end, we have seen a sharp rebound in job growth. Seventeen states (as of December 2020) have unemployment rates under 5% (5% unemployment is considered full employment in the US). Another eight states have an unemployment rate between 5% and 6%. Thirty-three of our states have an unemployment rate of less than 7%, and 43 of our states have an unemployment rate of less than 8%. The states with unemployment levels above 8% generally have stricter lockdown measures in place. This is significant to us because when the pandemic started two of the key questions we asked were (1) would businesses resume operations once stay at home orders were lifted and (2) would consumers return to those businesses when and if they resumed operations.

The last six months of economic data have given a pretty clear answer to these questions. Where lockdowns have been lifted, the economy has bounced back quickly. This leads us to believe that the elevated unemployment rate is more a function of lockdowns than of long-term economic damage. With lockdown orders continuing to ease in much of the country, we expect to see unemployment resume its downward trend. The current drop in new infections and hospitalizations supports continuing to relax lockdown orders around the country. Interestingly, data suggests the lockdown measures don't appear to have much to do with the infection and death rates for Covid-19.

Various studies have shown lockdowns were not as effective as hoped, and a simple review of the data supports these studies. We can compare the outcomes of the four largest states in the US, two of which followed long-term strict lockdown mandates and two of which have operated with much shorter, less strict lockdown measures. California and New York have had some of the strictest (and longest) lockdowns in the country, whereas Texas and Florida have had two of the shorter (and less strict) mandates in the country. Pulling data from https://covidtracking.com for these four states and then adjusting for population size shows that roughly 8.6% of Californians have been confirmed to have ever had Covid. The number is 8.9% in Texas, 8.2% in New York, and 8.4% in Florida. We can also look at total Covid related deaths, which account for 0.1% of the population in CA, 0.1% of the population in TX, 0.2% of the population in NY, and 0.1% of the population in FL. Both CA and TX do not report on the number of people ever hospitalized with Covid, but NY and FL both do. In NY, 0.5% of the population was ever hospitalized with Covid vs. 0.4% in FL.

Going back to the proposed stimulus with consideration of these facts, we are not sure the economy really needs the proposed $1.9 Trillion to stay on track. It looks like what it needs is a thoughtful relaxation of lockdowns. Many states appear to have found a balance between a plan that protects their population as much as they know how to and allowing their businesses to resume operations.

Interestingly, when you look under the hood of the proposed stimulus, it appears our government leaders may also believe immediate stimulus is not required. Included in the bill are $86 billion to fund multi-employer pension funds, which should not need bailing out due to the market recovering its losses from 2020 already. It also includes another $129 billion for elementary and secondary schools despite estimates that show 95% of those funds will be spent between 2022 and 2028 (after the pandemic is gone). There are also things like $30 billion for public transit and $50 billion for FEMA, which should not have needed bailing out from Covid-19. Further, much of the new proposal for stimulus directs funds to the states with the highest average unemployment rates, which initially may seem like a logical solution. However, looking at the nation's Covid numbers and economic data, it appears that a more appropriate solution might be a thoughtful approach to re-opening those states that are still in lockdown. We believe it is important to understand that borrowing from the future reduces future growth. Sacrificing future growth to solve an acute problem, like the lockdowns in the Spring of 2020 so our scientists and doctors could better understand and prepare for Covid makes sense. Once the data has demonstrated there are ways to reopen the economy with as good results as remaining in lockdown, we are not sure it makes sense to keep pulling future growth opportunities to the present.

As time marches on and data is accumulated, we believe our leaders are beginning to see this. In CA, Governor Newsom began relaxing stay at home measures despite the number of occupied ICU beds and the rate of infection remaining well above the state's target rates. In NY, Governor Cuomo relaxed restrictions too, allowing bars and restaurants to remain open to 11:00pm and to resume indoor seating at 25% of capacity.

All of this is reason to believe 2021 is a hard year to be out of the equity market. Yes, tax rates are likely to rise, but not in 2021. Have you noticed how few politicians are even mentioning this anymore? With businesses shut down and unemployment high, tax hikes will likely be put off until 2022.

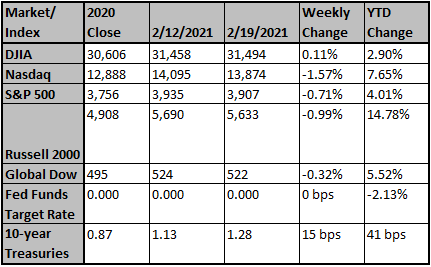

So, in short, we are still bullish. Profits are headed up and have much further to go, while interest rates would have to move substantially higher to make our cap profits model turn bearish. Yes, the 10-year Treasury yield hit 1.25% last week, but it would have to go to at least 2.0% or higher before it'd be a headwind for equities.

Eventually, the bull market will come to an end. Maybe it'll be the much faster money growth translating into persistently high inflation and interest rates, perhaps tax hikes will go farther and be more damaging than we think. Perhaps, some exogenous factor like a mutant strain of COVID forces another shutdown. Perhaps, perhaps, perhaps.

But for now, the market is still undervalued, the Fed is easy, the stimulus will boost the economy by borrowing from the future, and COVID data are very positive. We would never say that anything is certain, or that a correction won't happen, but the stock market is nowhere near bubble territory.

Source: Brian Wesbury, Chief Economist First Trust & The Wall Street Journal

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by FactSet.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

It's A Big Week For Biden's $1.9 Trillion Stimulus PlanHe...

The House of Representatives could vote on the package as soon as Friday.

Forbes

Feb 22, 2021

Pandemic Pushes Hospitality Workers Into New Careers

Faced with continuing furloughs and economic lockdowns, workers at hotels, bars and restaurants look to reinvent themselves.

Wall Street Journal

Feb 22, 2021

Moderna moves forward on plan to increase Covid vaccine s...

Moderna said it received "positive feedback" from the FDA on its proposal to increase the number of Covid-19 vaccine doses in each of its vials.

Upworthy

Feb 22, 2021