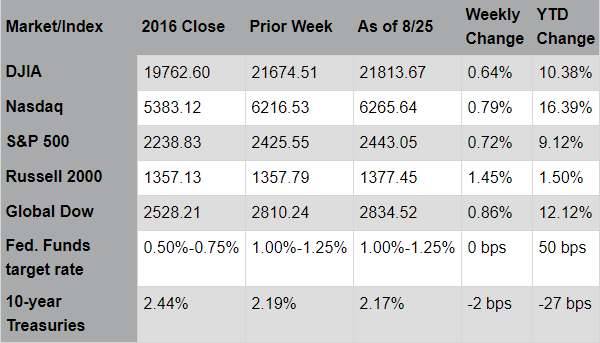

Last week, a broad market rally led by small cap stocks followed the previous week’s selloff. The Russell 2000® Index rose 1.45% while the other major indices also gained (the Dow Jones Industrial Average rose 0.64%; S&P 500® Index rose 0.72% and the NASDAQ gained 0.79%). As expected, trading volumes remained low. The annual conference of central bankers in Jackson Hole garnered attention although the meeting did not reveal any notable changes in Fed monetary policy. Chair Yellen stated that regulatory reform has been successful but some changes to reduce the regulatory burden may be appropriate to increase liquidity for bank lending. Retail stocks gained with several companies, including DSW, American Eagle and Abercrombie & Fitch reporting higher sales and greater foot traffic. The FAANG stocks, market leaders during the first half of the year, have retrenched over the past few weeks; some are in correction territory with losses in excess of 10%. New home sales were notably weak as strong demand continues to far exceed the low inventory of new homes. Overall, this was a quiet week beginning with the nation’s attention focused skyward at the solar eclipse and ending with the Jackson Hole meeting which produced no market changing events.

Source: Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Market Week

In looking ahead for the remainder of the year, the most frequently debated question is “What’s the likelihood of a significant market correction?” Historically, bull markets can continue, with periodic corrections, over many years. During an extended run, however, markets often experience rolling corrections across various sectors; this has been the case during the current bull market. Stocks in the Energy and Industrials sectors have endured a bear market, Retail stocks have experienced a correction, and Technology may be entering a correction phase. Several factors, including low interest rates, low inflation, and high employment levels, and moderate economic growth, support the extended bull market. While too early to speculate, heightened discussions about the likelihood of tax reform suggest the possibility for a significant economic boost. And, renewed efforts at deregulation are lowering business operating costs and providing growth opportunities. Several factors, including an improving economic outlook, the disciplined approach shown by many companies in pursuing growth strategies, and investment-friendly monetary policies across the globe, support a more optimistic view of the market. A recent report from the Organization for Economic Cooperation and Development (“OECD”), which tracks economic growth of forty-five countries, reinforces this outlook. The OECD report states that, for the first time in ten years, all of the countries are on track for growth in 2017. This report is consistent with the International Monetary Fund (“IMF”) which expects 3.5% growth in economic output in 2017 compared to 3.2% in 2016. The IMF projects 3.6% growth in 2018. Certainly, other catalysts could also accelerate growth and provide market momentum. Market vigilance is always important, and unforeseen events can create disruptions; but, the near-term outlook remains positive.

Source: Pacific Global Investment Management Company

Last Week's Headlines

- New home sales fell by a whopping 9.4% in July to a total of 571,000 (from 630,000 in June), the lowest rate in seven months, according to the U.S. Census Bureau and the Department of Housing and Urban Development. That figure is also 8.9% below the July 2016 sales figure of 627,000. The median sales price of new houses sold in July 2017 was $313,700, while the average sales price was $371,200. The seasonally adjusted estimate of new houses for sale at the end of July was 276,000. This represents a supply of 5.8 months at the current sales rate.

- The National Association of Realtors® reported that existing home sales followed a similar trend for the same month, as large demand drops in the Northeast and Midwest outweighed increases in the South and West. Overall, total existing-home sales, which include single-family homes, townhomes, condominiums, and co-ops, fell 1.3% to a seasonally adjusted annual rate of 5.44 million in July from a downwardly revised 5.51 million in June. July's sales pace is still 2.1% above a year ago, but is the lowest of 2017.

- New orders for manufactured durable goods decreased $16.7 billion, or 6.8%, to $229.2 billion in July, reported the U.S. Census Bureau. This decrease, down three of the last four months, followed a 6.4% June increase. Excluding transportation, new orders increased 0.5%. Excluding defense, new orders decreased 7.8%. Transportation equipment, also down three of the last four months, drove the decrease, $17.4 billion, or 19.0%, to $74.3 billion.

- In what could be her last appearance at the Federal Reserve's annual retreat in Jackson Hole, Wyoming, chair Janet Yellen defended regulations enacted in the wake of the financial crisis, while noting that the Fed remains open to possible "improvements" that would help "efficiently maintain a resilient financial system." At the same meeting, European Central Bank President Mario Draghi voiced similar sentiment. He criticized a global trend toward economic protectionism and warned that looser financial regulations could reinvigorate the types of incentive scenarios that led to the financial crisis.

- In the week ended August 19, the advance figure for seasonally adjusted initial claims for unemployment insurance was 234,000, an increase of 2,000 from the previous week's unrevised level. The advance seasonally adjusted insured unemployment rate was 1.4% for the week ended August 12, unchanged from the previous week's unrevised rate. During the week ended August 12, there were 1,954,000 receiving unemployment insurance benefits, unchanged from the previous week's revised level.

Eye on the Week Ahead

Observers will be monitoring the lingering effects of Hurricane Harvey on the Gulf region and the storm's potential economic and market impacts, including possible increases in oil and gas prices. Other potential influences during the week will likely include the second estimate of Q2 GDP figures and the August employment figures.