A recurring question we hear is, "How can the market continue to move higher with all of the new documented cases of Covid-19?" We believe currently available data provides valuable insight into why stocks may keep pushing higher, suggesting we may be able to balance the scales between health risks and economic risks.

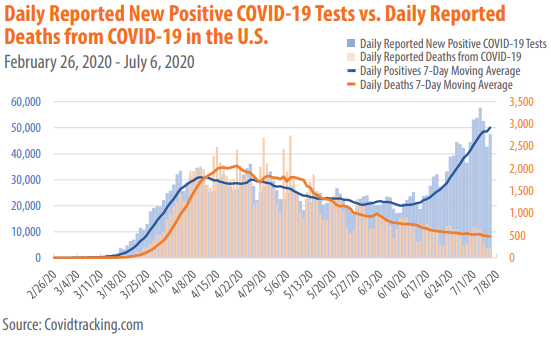

The first and second chart highlight that despite the increase in daily reported cases of Covid-19, the death rate has continued to drop.

Chart 1:

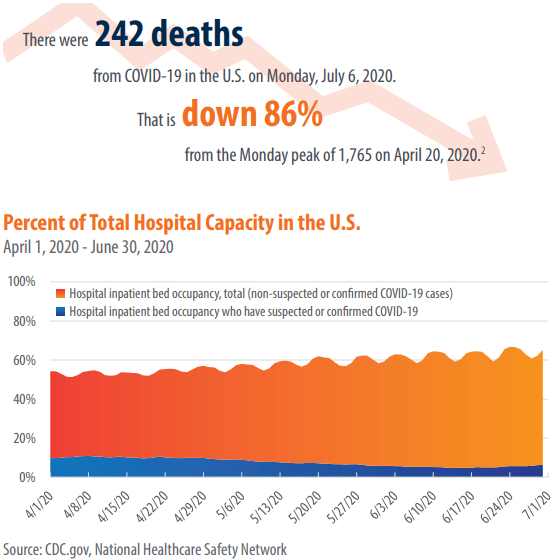

Further, the data shows us that while the percent of hospital beds who are suspected or confirmed to have Covid-19 has increased, it is still well below its peak levels in April. Also, the hospital bed occupancy due to Covid-19 has not increased in the same way that the total number of confirmed cases has.

Chart 2:

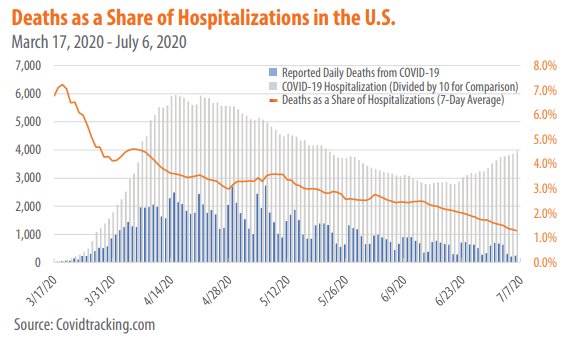

The third chart shows that the even though the percent of hospitalizations for Covid-19 has increased, the total daily reported deaths from Covid-19 is falling.

Chart 3:

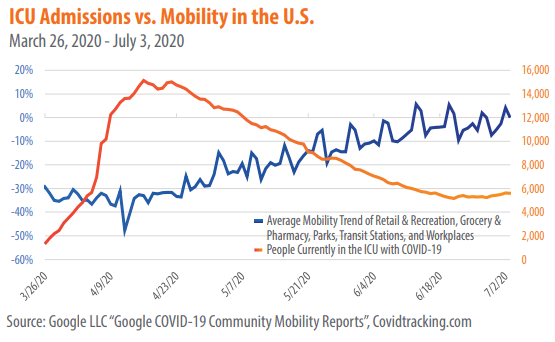

The fourth chart is interesting because it shows that even as the average mobility trend increases, the total number of people in the ICU with Covid-19 has been more moderate.

Chart 4:

As more cases are documented and more studies are completed, the medical community is learning how to better treat Covid-19. Further, those who are at the highest levels of risk appear to be taking steps to protect themselves through social distancing and other measures. Through the medical community's improved understanding of the virus, it is able to administer better treatment options. Also, as trials advance, therapeutic treatments like Remdesivir are found to improve patient outcomes.

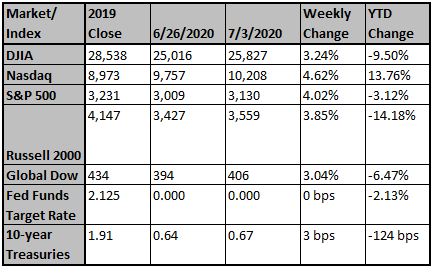

It is important to keep following these trends to confirm they continue to hold true. And for now, despite documented Covid-19 cases hitting new records, equities continued to power higher, led by technology shares and positive trial results for a virus treatment. Investors continued to favor megacap growth stocks as a safety trade with some states reversing course on reopening. The top-five names in the S&P 500 now account for nearly 23% of the benchmark weight. Growth stocks outperformed value for the first four days of the week but lagged on Friday as Gilead Science Inc. reported that its Remdesivir treatment reduces virus deaths by 62%. The S&P 500 Growth Index still outperformed the S&P 500 Value Index by 3% for the week. However, further treatments and ultimately a vaccine will allow the economy to reopen more fully, which will likely provide a larger benefit to cyclical and value stocks. In stock news, Walgreens Boots Alliance fell after the drugstore announced a loss and plans to reduce headcount by 4,000 in the U.K. due to reduced traffic. Bed Bath & Beyond Inc. shares slumped after the home-goods retailer announced it would close 200 of its stores permanently. By contrast, Amazon.com Inc., Netflix Inc. and Tesla Inc. hit all-time highs on Friday. Looking ahead, earnings season is set to unofficially kick-off on Tuesday with JP Morgan Chase Inc., Wells Fargo & Co. and Citigroup Inc. reporting results. With most firms removing future guidance and expectations for S&P 500 earnings to fall by 44%, individual stock swings are likely to be higher than average in the coming weeks.

Treasury yields dropped slightly last week as investors sought safe-haven government bonds in response to a rise in coronavirus cases. New coronavirus cases recorded their highest single-day increase last week, rising by more than 63,000 on Thursday, and the total number of U.S. cases topped 3 million. The rise in cases contributed to the drop in yields on concerns that it would inhibit states’ plans to reopen their economies. Initial jobless claims in the week ending July 4 were 1.314 million, which slightly beat expectations and was lower than the previous week’s total. Continued claims also fell, dropping by about 700 thousand from the previous week’s total, which was revised lower, to 18.062 million in the week ending June 27. It was the 14th consecutive week of declining initial jobless claims and the 5th consecutive week of declining continued claims, suggesting the labor market is recovering but still badly damaged. Meanwhile, on Friday, President Trump indicated in comments that a phase-two trade deal with China is unlikely at this point.

With the prospect of a Democratic sweep growing, recent discussions have been about the potential impact of raising the corporate tax rate. We will be the first to tell you that trying to handicap what will happen six months from now with certainty is a fool’s game. Uncertainty about the economy, COVID-19, and what a new president will do makes nothing guaranteed. We are seeing an increasing number of political and media talking heads say that the corporate tax rate impact on stocks is overblown for several reasons:

- Biden may not actually pull the lever to raise taxes in a weak economy;

- New government spending will offset the impact of the tax increase; and

- Tariff reductions on China will offset some of the impact of the tax increase.

We caution investors taking this view:

- Biden has said repeatedly in recent weeks that he is likely to raise the corporate tax despite a slow economy and all Democratic Senators want to raise the corporate tax rate;

- Tax increases are immediate and new spending takes years to come out. The scope of infrastructure spending is relatively small when compared to the size of the tax increases; and

- The proposed corporate tax rate increase shaves 11% off S&P 500 EPS.

Should Biden remove the tariffs on Chinese goods, the haircut from corporate tax changes will be reduced by half, but will still be a net drag. That assumes Biden will reduce tariffs on China, which seems unlikely in the short run. The good news is EPS is going up regardless of the policy paths taken.

Source: First Trust, Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com