What do you do when you are technically in a recession and inflation is running out of control???

Raise taxes and increase spending on climate change of course!

The Gross Domestic Product (GDP) came out at -.90% for Q2 today to confirm our country is technically in recession. The White House is trying to change the definition of recession like it does everything else these days, but the classic definition of a Recession is two quarters of negative GDP. Instead, we are being told we are in a transition and to pay no attention to the worst start of our countries economy since 1947. This transition talk is coming from the same people that told us six months ago that Inflation was transitory. Now with inflation at more than 9.1% annualized, it is hard to believe what they have cooked up next.

I cannot believe the news that broke last night after the Senate passes the $285bn semiconductor bill. The reconciliation deal that was being negotiated two weeks earlier is back, with tax increases and renewable energy provisions being added to drug pricing and health insurance subsidies.

Just two weeks ago Manchin said he could not support this deal because of inflation. Last night there was no change in the inflation numbers (because they came out this morning), and now Manchin is saying this deal will reduce inflation. In short, we have been watching the greatest political performance art in recent memory. The last two weeks have been nothing but show to get around Mitch McConnell’s promise to block semiconductor funding should the Democrats move forward on tax increases. Realizing that McConnell had the votes, Manchin expressed his opposition to the tax increases, and Republicans dropped their opposition to the semiconductor bill.

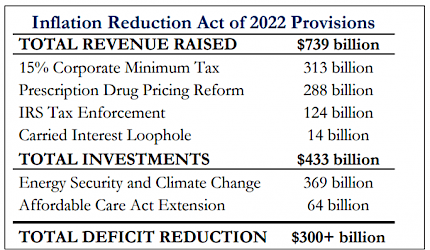

It is not a coincidence that this new tax deal was announced just hours after the semiconductor bill passed the Senate. Democrats played hardball and beat McConnell. The Inflation Reduction Act of 2022 includes clean energy tax credits and an extension of health insurance subsidies, while being paid for with drug pricing as well as a 15% corporate minimum tax, enhanced IRS enforcement, and ending the capital gains tax treatment of carried interest. No tax increases on US multinationals, small businesses, or high income individual surtaxes are included. The legislation does NOT boost fossil fuels. Manchin says he was promised a permitting reform vote in the Senate in September. The changes are modest and will not help boost gas production in the near term.

Raising taxes with negative GDP growth is not a winning issue. Regardless, Democrats have convinced themselves that raising taxes reduces inflation despite this never being the case. As such, the GDP report did not matter much, however, today's Q2 GDP report should make some hairs stick up on moderate Democrats.

Democrats claim that they have $300bn of deficit reduction. This allows Republicans to offer unlimited amendments on a host of items and the ability to pay for those items with the deficit savings. Democrats will need to protect their deal by vowing not to let Republicans divide them through amendments.

State And Local Tax Deduction (SALT): While most of the focus is on the Senate, Pelosi has a margin of four votes to hold in the House. And Manchin does not want SALT included. This could cause some real heartburn for House Democrats in high income areas who are vulnerable. These members have not drawn a red line tonight and probably will take the win even if SALT is not included.

WE CAN FIND NO PAST EVIDENCE THAT TAX INCREASES REDUCE INFLATION ….EVER

The Inflation Reduction Act assumes that the legislation will reduce inflation through several avenues. First, the reduction in the deficit will lead to less inflation. This will be primarily through tax increases. Additionally, price controls on prescription drugs will reduce inflation. We are highly skeptical. The drug price controls do not kick in until 2026. The tax savings will likely be minimal as we just reduced the deficit by $3 trillion and it would require the 15% minimum tax be implemented immediately.

More broadly, there is no evidence that tax increases reduce inflation. The 1968 and 1993 tax increases were justified as ways to get inflation down. Neither worked. In fact, inflation accelerated after the 1968 tax increase, and Alan Greenspan was forced to raise rates aggressively just six months following the 1993 tax increase. We got slower growth without the inflation reduction. This is happening just as employment growth is set to slow.

The agreement likely contains $369bn of clean energy tax credits for solar, wind, EVs, hydrogen, nuclear, and carbon capture among others.

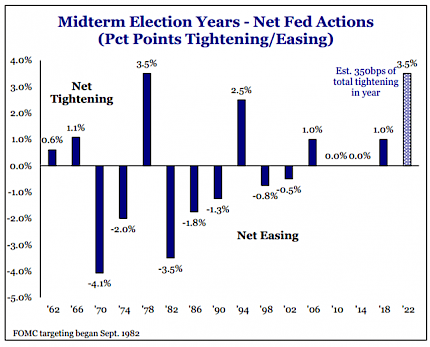

The Fed is on track to do the most net tightening in a midterm election year since at least 1974.

We are always being asked when the bleeding will stop in the markets. Typically, we look for a tipping point when everyone involved with policy making realizes they are on the wrong track and a big change needs to be made to restore sanity and change course direction. With almost $1 Trillion being approved by Congress in less than 24 hours, my answer to this question must be, there is no tipping point in sight and everyone should reach out to their Congressman and Senator to tell them to STOP THE MADNESS. Too much money printing has gotten us into this mess and continuing to print money will not get us out of it any time soon.

Click here to read the Wall Street Journal's take on the current economic climate: https://www.wsj.com/articles/recession-or-not-the-recovery-has-ended-11659031090

Source: Strategas

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com