In January 2020 President Biden entered office and declared he was going to change the energy policy in America at a record pace. We were going green baby and Biden was the man to take us there in record time. Then a few months later in March of 2020 when the markets thought the world was coming to an end because of Covid-19 and the markets lost more than 50% of its value in a matter of weeks, one economic sector caught our eye. The energy sector has long been a bellwether but had not performed well in the QE era (from 2009 to 2019). At the peak of the selloff in March 2020 oil spot price went negative, and they were literally giving oil away, (Oil traded below zero for a few hours) we knew this was a dislocated market and we started to overweight energy in our portfolios at that time.

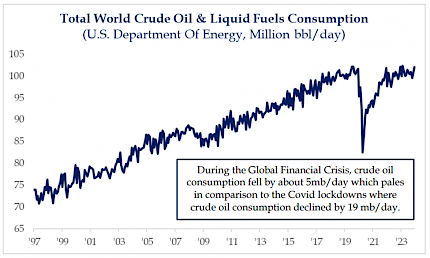

Fast forward, today we are overweighted energy in our portfolios and the performance has been great. Energy is our top holding and will probably continue as our top holding Into 2023. In November, the energy sector has had a difficult month in terms of both absolute and relative performance. This makes sense to the extent to which investors are increasingly worried about a recession next year. Still, we believe there are a variety of structural forces that should keep a bid in both the price of the underlying commodities and the prices of the shares of companies that represent the sector. They include: the emergence of the ESG movement; an American administration hostile to the fossil fuel industry; a global political elite insistent on the adoption of the rapid use of renewable energy sources regardless of cost; the end of negative real interest rates; growing geopolitical instability; and a growing desire on the part of major oil companies to return money to shareholders rather than punch holes. These circumstances have led to two consecutive annual gains of 50% for the S&P 500 Energy sector. To the extent to which there remain roughly one billion people on the planet without reliable access to electricity, it is not difficult to understand how demand for crude oil and liquid fuels remains somewhat inelastic. In our opinion, continued capital discipline will determine whether the sector will continue to outperform. We have not yet seen any signs to the contrary.

TEN ENERGY DATA POINTS RELATED TO THE MARKET & ECONOMY THAT ARE NOTEWORTHY

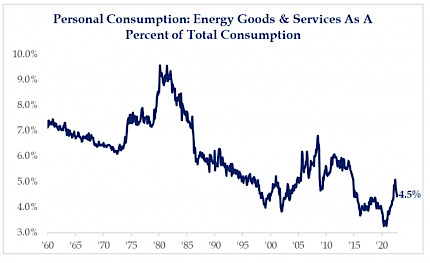

1) The share of personal consumption on energy goods and services had risen rapidly to 5.1% from all-time lows of 3.3% before falling back to 4.5% more recently. This relationship is worth watching for a country that is so dependent upon consumer spending. In the 1970s, energy garnered a much larger share of consumption topping out at more than 9.0%.

2) Oil expenditures are on pace to exceed the post financial crisis high which occurred in 2013. While oil prices have fallen from their 2022 highs, the average daily price in 2022 remains elevated at $95. Demand in the U.S. is nearly back to 2019 levels.

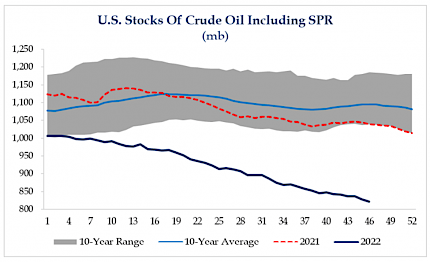

3) U.S. stocks of crude oil sit roughly 275 million barrels below their 10-year average. The size of our Strategic Petroleum Reserve is at its lowest level since 1984. Since President Biden took office, the SPR has declined by roughly 40% from 640 million barrels to 390 million barrels.

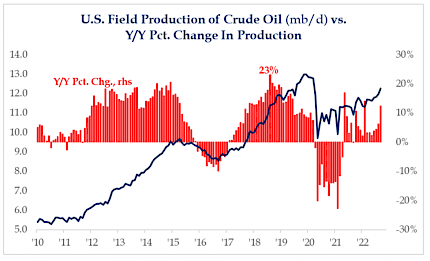

4) U.S. field production of crude oil as of the end of September was 12.3 million barrels per day. Since the bottom in May of 2020, production has slowly increased over the past two years. At 12.3 mbd, field production is still below the pre-Covid peak levels of 13 mbd produced at the end of 2019.

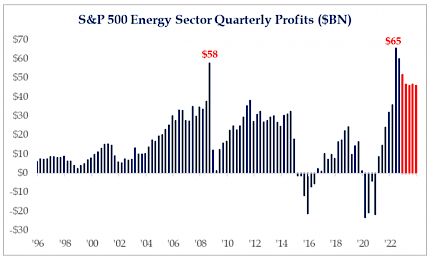

5) Over the last twelve months, the S&P 500 Energy sector has produced $193 billion in profits. Quarterly profit levels are likely to decline given current prices in the underlying commodities, however. Still, the consensus believes the sector will earn between $40-50 billion each quarter for 2023.

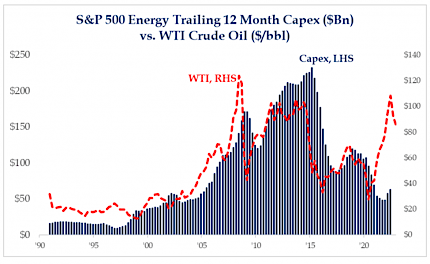

6) S&P 500 energy sector capex is about 75% below the levels seen at the height of the shale boom. Based on the trailing twelve-month data, energy companies have spent roughly $60bn despite spending more than $100bn the last time oil prices were at comparable levels. The uptick seen over the last two quarters is largely attributed to inflation rather than new projects.

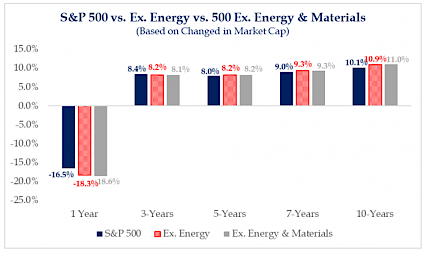

7) Prior to 2020, simply not owning the Energy and Basic Materials sectors was a source of outperformance over the trailing 3, 5, 7, and 10 years. We believe this dynamic will be difficult to repeat given the current difficulties in obtaining energy project permits and the demand for commodities most often used in Electric Vehicles.

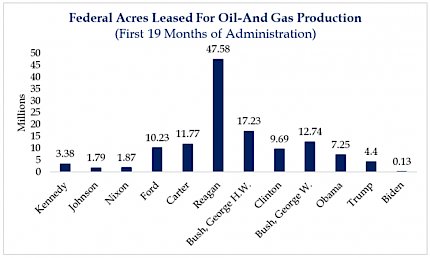

8) During the Biden Administration there have only been 130k Federal acres leased for oil & gas production. Not since Harry Truman has a president leased fewer acres of federal land or offshore rights to develop oil and gas resources. (Offshore drilling was in its infancy during the Truman years.)

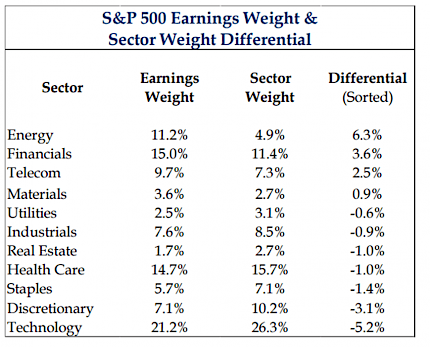

9) A simple comparison of each sector’s contribution to the earnings of the S&P 500 and its respective market cap weight in the Index indicates that the Energy sector currently provides investors with the greatest earnings power. The sector’s earnings weight is more than double its weight in the overall index.

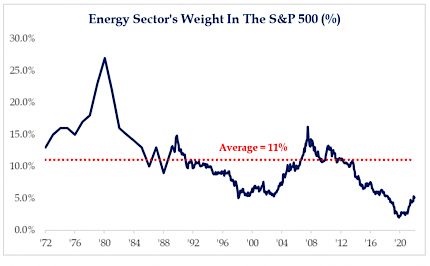

10) Energy is now 4.9% of the market cap of the S&P 500, which remains less than half of its long-term average of 11% since the 1970s.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance or specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com