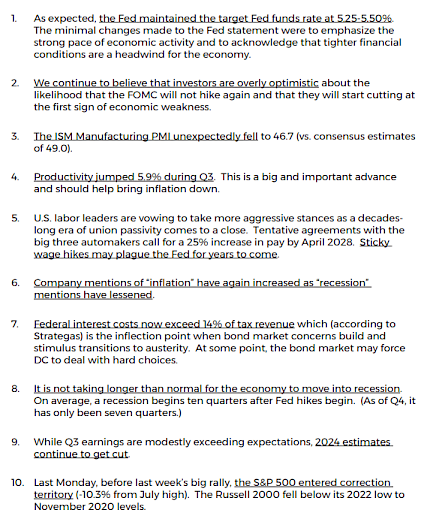

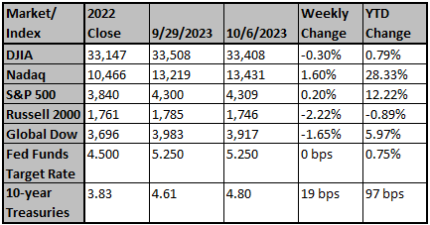

Stocks advanced for a third week in a row (S&P 500 +2.2%). Small stocks (Russell 2000) were up 5.45%. Disinflation optimism and weaker labor data supported peak Fed and soft-landing narratives. Best sectors were real estate (+4.5%) and materials (+3.7%); worst sectors were consumer staples (+0.6%) and energy (+0.9%). Source: Bob Doll, Crossmark Investments Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to b… View More

Authors

Post 121 to 130 of 607

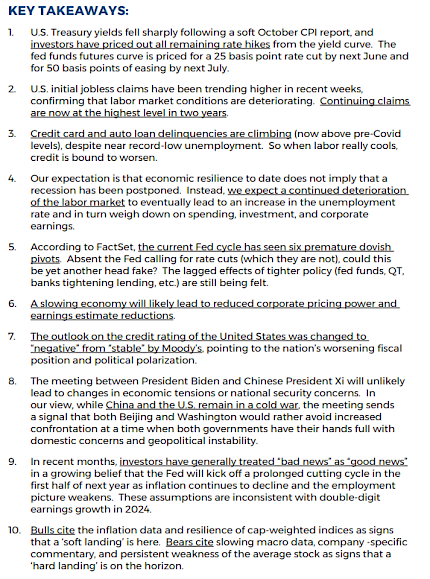

Several weeks ago, we decided to reconstruct the S&P 500 by excluding the Magnificent 7 stocks from the sectors in which they normally reside and by creating a new separate sector for them. The characteristics of the new group of stocks were even more surprising than we might have thought. Looked at in this way as of the end of the third quarter, these seven stocks would represent the Index’s largest “sector” at roughly 28% of the S&P 500, while representing only 17% of its earning… View More

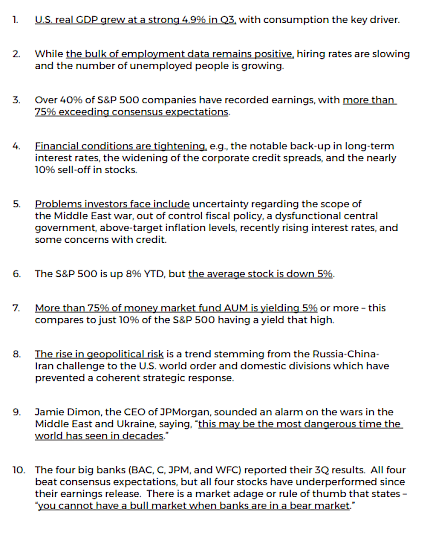

After reaching correction territory on Monday, stocks advanced each day with the S&P 500 (+5.9%) posting its best week in a year. Small stocks (Russell 2000 +7.6%) had their best week in two and a half years. Ten-year Treasury yields dropped 30bp for the week. Soft economic data and a dovish Fed meeting were among the supports. Best sectors were real estate (+8.6%), financials (+7.4%) and consumer discretionary (+7.2%). Laggards included energy (+2.3%), consumer staples (+3.3%), and healthca… View More

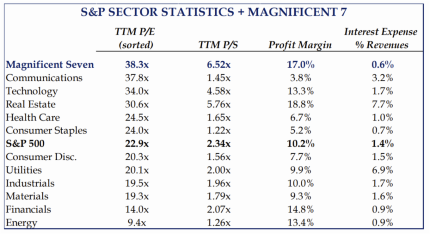

The Fed kept rates unchanged at today’s meeting, but whether they are done with rate hikes or simply at a pause is yet to be determined. Today’s Fed statement itself was mostly a copy/paste of September, with some minor wording changes noting that the economy is growing at a “strong” rather than “solid” pace, and employment gains have “moderated” rather than “slowed”. The only new information came with the addition of “financial” conditions to previously noted credit con… View More

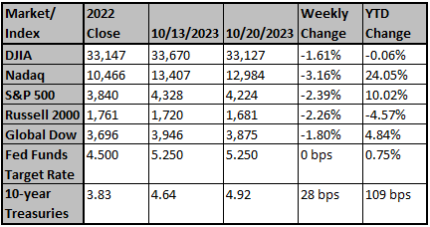

Equities were lower again last week as the S&P 500 (-2.5%) fell for the second straight week and finished the week at the lowest levels since April. NASDAQ is now 12% below the recent July peak. Treasuries yields fell on the week, though not before the 10-year yield on Monday rose above 5% for the first time since 2007. The only positive sector for the week was utilities (+1.2%); worst sectors were communication services (-6.3%), and energy (-6.2%). Source: Bob Doll, Crossmark Investments… View More

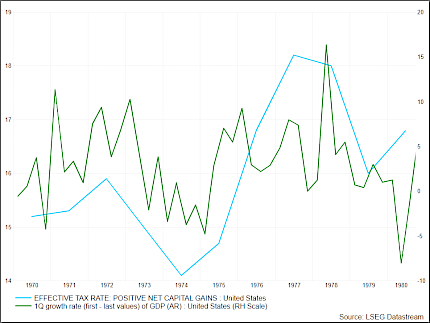

WHY WE BELIEVE LONG-TERM INTEREST RATES ARE RISING Reversion to the Mean: typical spread between 10-year & inflation is 200 bps Greater Sense Inflation is Structural: Slowing Globalization, Deficit Spending, Environmental Priorities Persistent Deficits 5% of GDP Spooling Effect of Net Interest Expense in the Absence of QE Fed has continued QT After SVB Pause Foreign Demand Weakening by Choice (Saudia Arabia) or Circumstance (China) REASONS INFLATION LIKELY TO BE STRUCTURAL C… View More

This brief note is not meant to cover all the events of recent days or exhaust the potential economic and market implications of the war in the Middle East. Our goal is to provide you insight into our view of the potential impacts of these events on the global markets. Factors impacting economic and market conditions: Short Term This war could be lengthy, as Israel has stated its determination to destroy Hamas. Any escalation to include Iran is speculation at this point. The U.S. and W… View More

At the end of October, we will get our first look at real GDP growth for the third quarter, and it looks like it was solid. We’ll have a more exact estimate a week from now– after this week’s reports on retail sales, industrial production, and home building – but it looks like the economy grew at about a 4.5% annual rate. Even if that turns out right, however, the underlying pace of growth is much slower than what happened in Q3. From the end of 2019 through the third quarter, the avera… View More

Back in 2008, Ben Bernanke and Hank Paulson, using fear of financial collapse, convinced President Bush and Congress to 1) pass a $700 billion bailout of banks (called TARP) and 2) allow the Federal Reserve to pay banks interest on reserves at the same time the Fed moved from a scarce reserve model of monetary policy to an abundant reserve policy. These policies, to spend and print massive amounts of money, were super-sized during COVID. Both policies proved incredibly damaging. The 2008 financ… View More

Yesterday House Speaker Kevin McCarthy was voted down as House Majority leader by just a few members of his own party and most all members of the opposing party. There are no more Norms in Washington but does the end justify the means. What has been going on in Washington for more than a decade is not sustainable and something needs to change. The last few days in Washington has looked like a circus act. The Government is going to shut down because Congress has not approved spending for next ye… View More