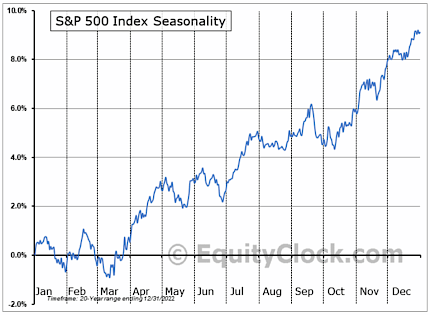

While September had been a bit sloppy, will further weakness in October weigh on investor sentiment before the seasonally strong period begins? As shown by the S&P 500 index seasonality chart below, weakness in the last two weeks of September and the first two weeks of October is common. However, we must also understand that the big down move in the market during that period came from historical crashes such as the “Financial Crisis” in 2008. Excluding those periods, the market still ten… View More

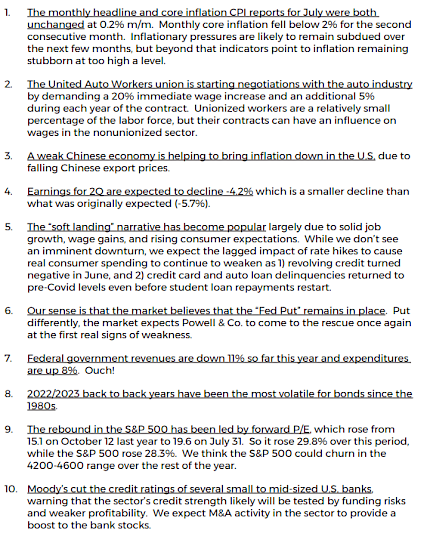

Authors

Post 131 to 140 of 607

We have plenty of data reports to go, but, so far, the third quarter is shaping up to be a strong one for the US economy. The Atlanta Fed’s GDP Now model is tracking a Real GDP growth rate of 4.9% for Q3, which would be the fastest quarterly growth rate since the earlier part of the COVID recovery. Our models aren’t tracking quite so high but are projecting growth at about a 4.0% rate, still strong by the standards of the past couple of decades. However, we would not get too excited about … View More

The University of Colorado Buffaloes are undefeated and suck up a lot of oxygen in the college football world. After just three games as the new head coach, Deion Sanders was interviewed by 60 Minutes. For now, the Buffs have gone from irrelevant to essential in the college football world. In the competitive arena of sports or business you need to stand out to be noticed. But, when you’re the government, standing out isn’t hard to do. This week, the Federal Reserve is set to release a new s… View More

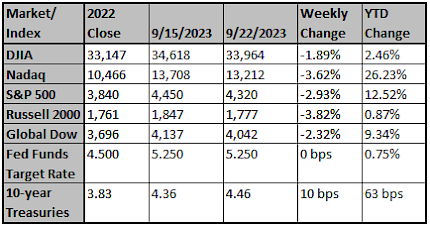

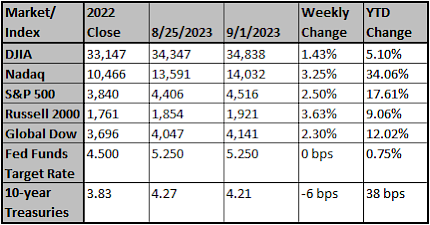

Stocks fell last week (S&P 500 -1.3%) as the S&P 500 and NASDAQ fell below their 50-day moving averages. The market’s mood was primarily defensive with investors focused on the renewed back up in interest rates, dollar strength, and the spike in oil prices. Positive sectors included energy (+1.4%) and utilities (+0.9%); underperformers included industrials (-2.9%) and materials (-2.5%). Source: Bob Doll Crossmark Investments Chart reflects price changes, not total retur… View More

Back in the 1980s, President Reagan took enormous political heat (Sam Donaldson comes to mind) for being fiscally irresponsible. His offense? Presiding over a budget deficit that peaked at 5.9% of GDP in Fiscal Year 1983. But at least Reagan had an excuse. Actually, multiple excuses. The unemployment rate averaged 10.1% in FY 1983, which pushed up spending, while reducing revenue. The Reagan tax cuts were phased-in, so many people pushed off income (and taxes) into future years. Finally, the US… View More

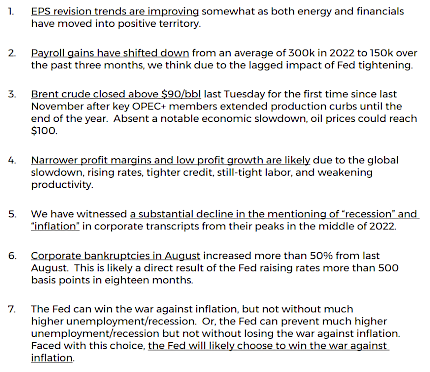

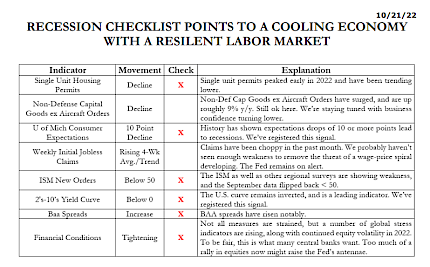

Since the beginning of 2022, the media has regularly warned a recession is coming. As we suggested previously, if a recession did occur, it would be the most well forecasted recession ever on record. Something else has indeed happened. As discussed in numerous measures suggest a recession is forthcoming. However, that recession has yet to reveal itself. Such has led to a fierce debate between the bulls and the bears. The bears contend that a recession is still coming, while the bulls are bettin… View More

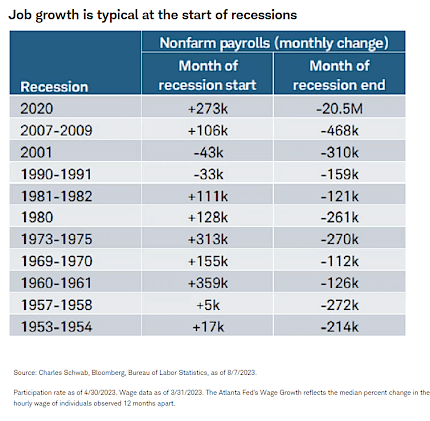

Will the economy roll into a formal recession, or is a recovery underway? It's a close call. We've believed all year that the economy has been undergoing a series of "rolling recessions" affecting various industries and sectors. The question is whether it eventually would roll into a formal recession. To date, it's still not clear. Despite the Federal Reserve's efforts to cool economic growth and control inflation, job growth has remained relatively strong—although job expansion historica… View More

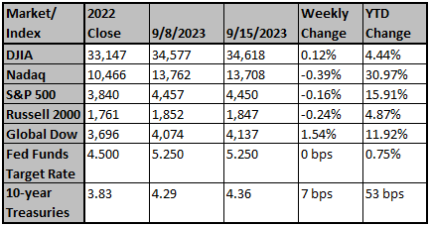

Stocks fell again last week (S&P 500 -0.3%) with big tech hit hardest. Inflation remains the primary concern despite a good CPI report on Wednesday – PPI report on Friday was less good. Best sectors were energy (+3.5%) and healthcare (+2.5%); worst sector was technology (-2.9%). Source: Bob Doll Crossmark Investments Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific inve… View More

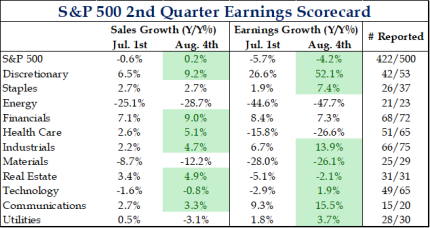

2Q Earnings Season 84% Complete With the majority of earnings season complete, the overall picture is one of better-than-expected earnings and sales. Earnings growth for the quarter is expected to decline -4.2% which is a smaller decline than what was originally expected (-5.7%). Sales are now expected to eke out a small gain at 0.2% versus a decline of -0.6%. The energy sector is where the notable weakness is occurring but with oil prices on the rise again and expectations just about as bad … View More

Anyone hoping for excitement from today’s Fed statement was severely disappointed. As expected, the federal funds rate was lifted 25 basis points (bps) from a range of 5.25 to 5.50%. With the exception of the rate hike and slight wording changes – the “modest” pace of economic growth strengthened slightly to “moderate” – today’s statement was a virtual carbon copy of the mid-June release. It's worth noting that, while the Fed did not release new economic forecasts today, the eco… View More