The economy slowed substantially in the last quarter of 2023 from the rapid pace of the third quarter, but, as we explain below, still expanded at a moderate rate. Some will take this week’s Real GDP report to confirm their prior view the recession is simply not in the cards for the US economy, but we still think a recession is more likely than not. Why do we still think a recession is coming? Because monetary policy is tight whether you like to use the yield curve, the “real” (inflation-… View More

Authors

Post 111 to 120 of 608

The leaders of the House and Senate have come up with a new budget deal, and many people aren’t happy. It still needs passing by January 19th, or else the government, evidently, may shutdown. We doubt that this will happen, but the fight over government spending seems to drag on year after year after year. It’s not hard to understand why. Non-defense spending by the federal government (including entitlements like Social Security) has climbed dramatically. 10% of GDP in the 1960s 14.8% o… View More

Each year we like to check out our friend Bob Doll's annual predictions. He is right more than wrong, but last year's markets left Bob's predictions with an unusually mixed bag. Let’s see what Bob thinks is in store for 2024: The main focal point for 2024 will likely be whether or not investors can enjoy a Goldilocks environment; namely, further significant progress on inflation, decent economic growth, and double-digit earnings growth ... Source: Bob Doll Crossmark Investments �… View More

Across Wall Street, on equities desks and bond desks, at giant firms and niche outfits, the mood was glum. It was the end of 2022 and everyone, it seemed, was game planning for the recession they were convinced was coming. Over at Morgan Stanley, Mike Wilson, the bearish stock strategist who was rapidly becoming a market darling, was predicting the S&P 500 Index was about to tumble. A few blocks away at Bank of America, Meghan Swiber and her colleagues were telling clients to prepare for a … View More

With the ever-growing popularity of online shopping and online communications, you should always have your guard up in the cyberworld. Criminals will use any situation to their advantage–especially when it comes to annual holidays. Below you’ll find a few examples of commonly used seasonal and holiday scams, and what you can do to protect yourself. Fake Shipping Notifications End of the year holidays invite a greater likelihood of this common phishing attack, but this is a scam you must … View More

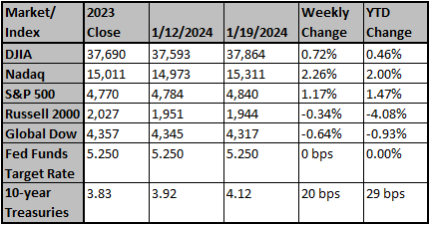

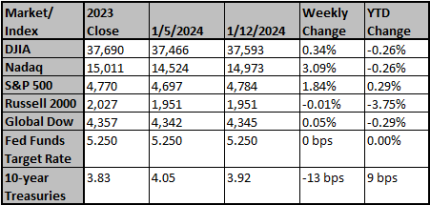

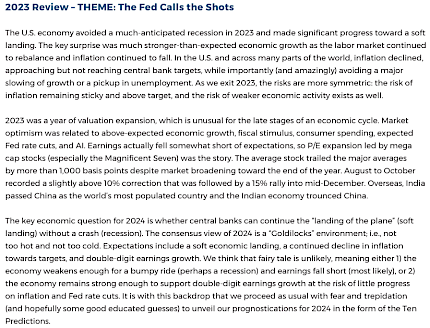

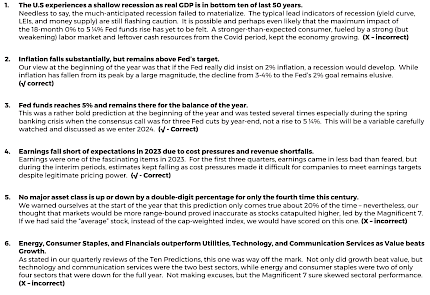

2023 certainly was a challenging year for investors. Multiple expansion despite flattish earnings confounded most investors even as a much-anticipated recession did not materialize. Investors enjoyed falling long-term interest rates in the back part of the year, even as the Fed raised rates multiple times reaching the 5 ¼% level. Equity concentration accelerated with the Magnificent 7 far outpacing the average stock. Volatility levels were low most all year, especially for stocks. By year’s e… View More

The Federal Reserve declared victory today, projecting a soft landing as its base case in the years ahead, with more cuts in short-term rates, and with inflation gradually getting back to its 2.0% goal without a recession. Unfortunately, we think the Fed is declaring mission accomplished too early. The Fed didn’t change short-term interest rates today, nor did it alter the pace of Quantitative Tightening, but it made major changes to its projections for short-term interest rates. Not one poli… View More

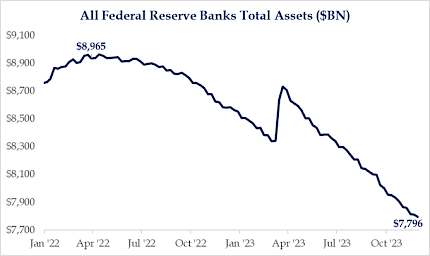

Lately, there has been much discussion about how soon the Fed will have to cut rates as many believe they are too restrictive. While we are cautious about the ultimate message rates have for equities, we are even more concerned about how little balance sheet runoff is discussed in the context of cuts. If we look back to 2019, the last time the Fed began cutting rates during balance sheet runoff, the runoff lasted just a few more weeks before the Fed ultimately had to reverse course due to repo m… View More

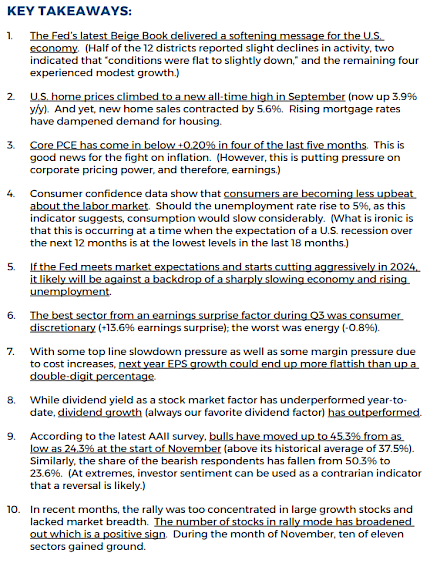

The S&P 500 was up (+0.8%) for the fifth week in a row. Small cap stocks again powered higher (Russell 2000 +0.1%). Treasuries had a strong week with the ten-year yield falling 25 basis points. Best sectors were real estate (+4.7%) and materials (+2.8%); sectors losing ground included communication services (-2.5%) and energy (-0.1%). Source: Bob Doll, Crossmark Investments Chart reflects price changes, not total return. Because it does not include dividends or splits, it should no… View More

Don’t forget to give to Charity this Holiday Season! As the end of the year and the holiday season approaches, we will all see an uptick in charitable solicitations arriving in our mailboxes and by email. Since some charities sell their contributor lists to other charities, frequent contributors may find themselves besieged by requests from various charities with which they are unfamiliar. Watch Out for Charity Scams! You need to be careful, as scammers out there are pretending to be l… View More