$800 billion The approximate value of stock that S&P 500 companies are on track to repurchase this year, which would eclipse 2007’s record buyback bonanza of $589.1 billion. Among the biggest buyers: Oracle, Bank of America and JPMorgan Chase. The historic spending spree isn't giving share prices the boost companies bargained for, and has some analysts worried that they're buying at excessive valuations during the peak of the economic cycle. Separately, business borrowing is picking up… View More

Authors

Post 501 to 510 of 606

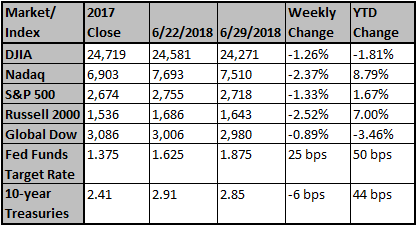

The US has officially imposed tariffs on $34 billion of imports from China, and China in response has imposed tariffs on $34 billion of US goods exported to China. We want to share some of the relevant facts to put the tariffs in perspective. In 2017, total US imports were $2.9 trillion and total US exports were $2.35 trillion. The $34 billion of tariffs equates to 1.2% of total US imports, and 1.4% of total US exports. We think this is important because both the US and China are imposing… View More

Looking at Walgreens adjusted 2018 third quarter (Q3) earnings per share (EPS) of $1.53 and revenues of $34.33 billion (surpassing analysts’ expectations of $1.47 and revenues and $33.65 billion respectively), we are reminded of the importance for investors to control emotional responses. After beating on earnings, and raising its quarterly common dividend by 10% to $0.44 a share, along with announcing a new $10 billion share repurchase program, which is scheduled to be completed in the ne… View More

Investor Sentiment is less bullish but not yet bearish (7 on a scale of 10, with 10 being the most bullish). Europe has become strikingly out of favor over the last few months and Technology remains the preferred sector though optimism towards FAANG has moderated slightly. A majority of investors are betting on 2 more hikes this year and a year- end 10-year yield around 3%. Trade dominates the list of concerns and long USD is a widely held view. The NASDAQ and Growth indices outperformanc… View More

At the beginning of every new year we look toward the future in anticipation of what it will bring, and for years we've shared Bob Doll's Top 10 Predictions because he tends to get over 70% of them correct every year. As we begin the second half of the year, we wanted to share an update on how this year's predictions are working out. Below is his mid-year scorecard. The BLUE predictions are correct so far, and the RED predictions are too early to call yet. So far, 2018 has been a … View More

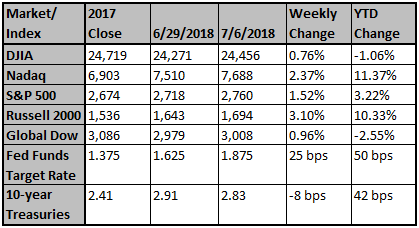

Trade headlines are likely to continue dominating markets; that is, until the second quarter corporate earnings season begins in July. The trade tensions between the U.S. and China continued. Thus far, the Trump administration has threatened to impose tariffs on roughly $450 billion of Chinese goods, nearly equivalent to the total value of Chinese imports last year. China promised a strong response including retaliatory tariffs as well as increased regulatory scrutiny on U.S. companies o… View More

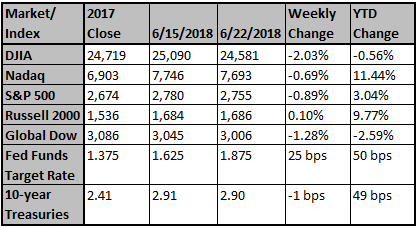

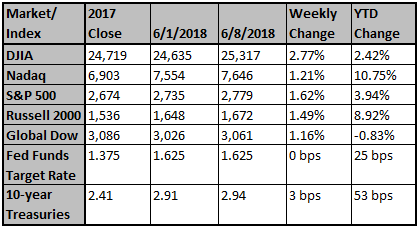

Markets were mixed last week as macroeconomic and geopolitical developments continued to dominate headlines. On Wednesday, the Federal Reserve raised interest rates and plotted a slightly more aggressive timeline for future rate hikes. In doing so, the committee noted that “economic activity has been rising at a solid rate.” On Thursday, the European Central Bank announced plans to end its bond-buying program in December. The move signaled the beginning of the end of extraordinary… View More

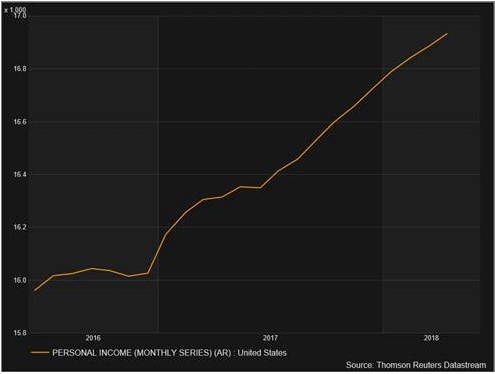

There has been a lot of talk as to whether the latest tax reform from Washington is having an effect on our economy. You hear “this tax cut was only for the rich and does nothing for the average working man”. We hear how “this tax plan is the worst thing that has ever happened to us” and how some in congress have vowed to repeal it because “it is pure evil and only benefits the one percenters”. We here at Fortem are not in that camp because all the economic data we rely on says ot… View More

To little surprise, the Federal Reserve hiked interest rates by 25 basis points following yesterday’s meeting. Of much greater note are the hawkish changes made to the text of the Fed's statement (and with no dissents), as well as changes in the forecast materials. While these changes are clearly in line with the continued improvement in economic data over recent months, it's a positive development from a Fed that has been exceedingly cautious over recent years in upgrading its outlook on… View More

Anxiety has heightened among investors and the wall of worry seems higher today than it was at the February market lows. Trade continues to be a prominent brick in the wall of worry and while it is a risk, it is manageable in our view. Even though it may seem like the US had a tough G7 meeting over the weekend. Data points (CEO Confidence, capex, unemployment, wage growth, PMIs, consumer confidence) still signal that there is time left in this business cycle and that the economy and markets can … View More