September and October are traditional the most volatile months of the year. History shows us the largest one day percentage drop in history was 31 years ago, known as Black Monday, on October 19, 1987. On that day, stockbrokers in New York, London, Hong Kong, Berlin, Tokyo and just about any other city with an exchange stared at the figures running across their displays with a growing sense of dread. A financial strut had buckled and the strain brought world markets tumbling down. However, mar… View More

Authors

Post 481 to 490 of 604

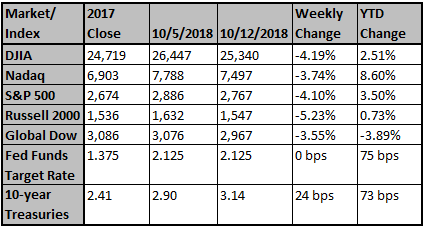

U.S. stocks slumped to close sharply lower today as the Dow Jones Industrial Average sank more than 800 points and the S&P 500 had its worst day since February as technology stocks went into a freefall. Investors were spooked by rising bond yields dumped equities in all sectors, triggering a broad market rout. The Dow Jones Industrial Average DJIA, -3.15% skidded 831.83 points, or 3.2%, to 25,598.74, logging its worst one-day drop since February. The S&P 500 index lost 94.66 points, o… View More

Investors still seem to be underestimating the revitalizing effects of the fiscal stimulus and regulatory easing while overestimating the potential negative impact of a “trade war.” This suggests to us an increase in real GDP, inflation, bond yields, earnings, and stock prices as the year progresses. The pace of stock price appreciation (the multiple), however is likely to slow as the real economy lures liquidity away from financial assets. We continue to have a bias of value over growth and… View More

Just reaching an agreement was the first step. Now the US Trade Promotion Authority (TPA) process will kick in. By the end of 2018, we expect the International Trade Commission to issue a report for Congress detailing the economic impact of the renegotiated NAFTA agreement. The purpose of this report is to be informative for members of Congress before they vote. We have no idea how the report may score the benefits of enhanced intellectual property protection and the new financial services rules… View More

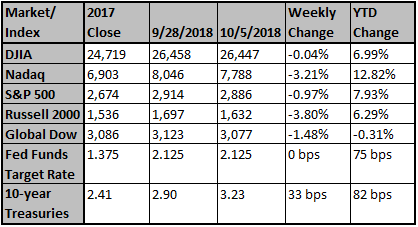

As expected, the Federal Reserve raised rates by 25 basis points yesterday. And at this point, the outlook for the remainder 2018 looks largely determined, with both 75% of Fed officials and the markets pricing in one more rate hike in December to make it four for the year. What remains to be seen – and the focus for many with yesterday's release – is how policy will develop in 2019 and beyond. The only substantive change in yesterday's statement was the removal of a sentence noting the sta… View More

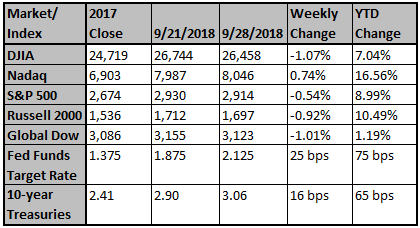

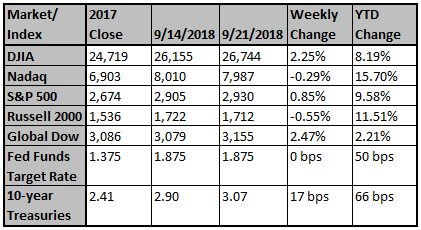

Trade tensions continued to dominate the headlines; on Monday, the U.S. imposed an additional 10% tariff on $200 billion of Chinese goods. The tariffs will rise to 25% on January 1st in the absence of a trade agreement. Despite the announcement, the Dow Jones Industrial Average rose 2.25% while the S&P 500® Index gained 0.85% while the Nasdaq fell 0.29%, the Russell 2000® Index fell 0.55%. The Dow and S&P 500® both posted record highs on Thursday as the longest bull market on r… View More

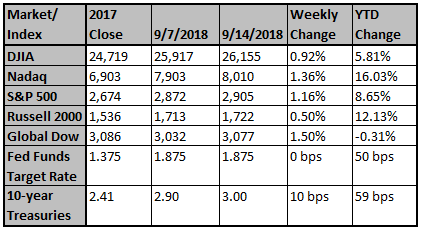

Significant headline news events were in short supply last week yet the major indices moved higher which has been the path of least resistance. For the week, large caps outpaced small cap stocks; the market leading Nasdaq rose 1.36%, followed by the S&P 500® Index (1.16%), Dow Jones Industrial Average (0.92%) and the Russell 2000® Index (0.50%). Economic data, including the Consumer Confidence Index, continue to support the markets. The Index’s 100.8 reading for August is the seco… View More

Unemployment, wage growth and other data still looking very strong as the markets take a breather last week

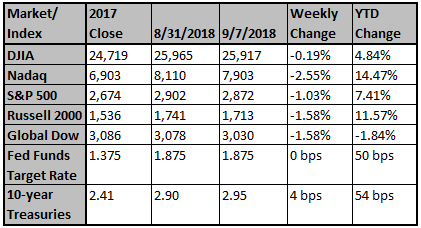

September began with across-the-board declines in response to uncertainties related to trade tariffs with China and the NAFTA negotiations with Canada. Last week the Dow Jones Industrial Average led the markets with a fractional 0.19% loss; the S&P 500® Index declined 1.03%, the Nasdaq fell 2.55% and the Russell 2000® Index lost 1.58%. On Wednesday, trade negotiations between the U.S. and Canada resumed but the parties had not reached an agreement as the week ended; the pressure builds… View More

NAFTA negotiators remain upbeat about the prospects of a deal. This will be an "agreement in principle" rather than a full deal which means that while it won't be signed, it can still trigger the formal Congressional review so that Mexico's current President is able to sign it before his term ends and he leaves office. However, on Friday, negotiations between the U.S. and Canada appear stalled in meeting the White House’s imposed deadline. Even so, President Trump plans to notify Congress o… View More

Last week you heard a lot about the longest bull market in our countries history. The Purest definition of a bull market is “a market advance without a pull back or sell of greater than 20%”. We do not necessarily agree with the "longest bull market" headlines from last week. Both 2011 and 2015 witnessed massive drawdowns at the stock level with over 70% of issues down 20% in 2011 and 63% during 2015. The Russell 2000 was down by 30% and 27% in each respective year and global equities also e… View More