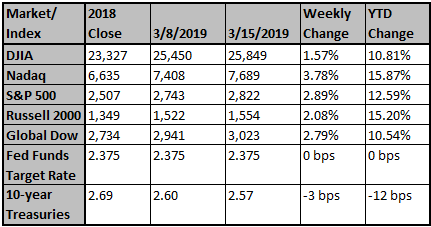

For the first time since October, the S&P closed above the 2815 level to end last week. Technology has driven this last leg higher with the equally-weighted Nasdaq 100 right on the cusp of fresh all-time highs and the Semiconductors continuing to exhibit leadership. More broadly though, the market still appears to be in the midst of a consolidation phase with the Russell 2000 still below its February highs and the Transportation stocks again lagging. These aren’t major blemishes, but … View More

Authors

Post 451 to 460 of 606

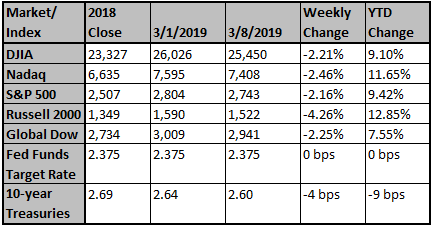

While last week marked just the second down week of the year for the S&P, many individual names have been consolidating since mid-February. The equity markets declined, with the worst 1-week performance this year, on mixed economic data. For last week the Russell 2000® Index, the weakest performer, fell 4.26%, followed by Nasdaq (-2.46%), the Dow Jones Industrial Average (-2.21%), and the S&P 500® Index (-2.16%.) Low trading volumes suggest that many investors are sitting on the… View More

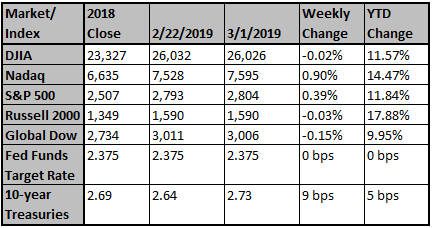

Equity markets were mixed last week as no significant events motivated investors to buy or sell. The Nasdaq led the indices this week with a 0.90% gain, followed by S&P 500® (0.40%), Dow Jones Industrial Average (-0.02%) and Russell 2000® Index (-0.03 %). Early in the week, President Trump announced a postponement of additional tariffs on $200 billion of Chinese products with no extension date provided. Reports later in the week indicated that President Trump and President XI may m… View More

President Trump’s announcement last night delaying an escalation in China tariffs from going into effect on March 1 shows that we are moving towards a deal in the coming month.Trump is becoming more pro-growth and is looking for a deal ahead of his re-election. Avoiding the escalation of tariffs prevents an additional $50bn of tariffs from going into effect in CY 2019. We are having a harder time seeing a path to removing existing tariffs, which will be largely dependent on the Chinese making … View More

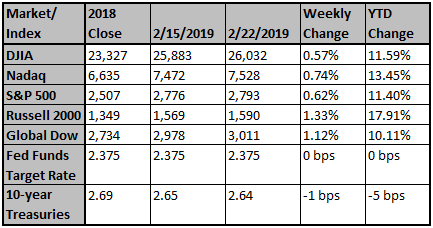

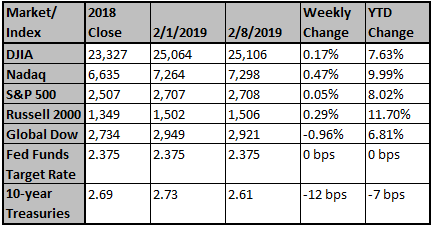

While the market has paused over recent days, the equally-weighted S&P has continued to outperform and reflects an improvement for the “average stock.” The equity markets started last week on a positive note before retreating as trade concerns and Brexit dampened investor enthusiasm. The major indices rose fractionally: the Nasdaq gained 0.55%, followed by the Russell 2000® Index (0.29%), the Dow Jones Industrial Average (0.17%) and the S&P 500® Index (0.05%.) Trade concerns… View More

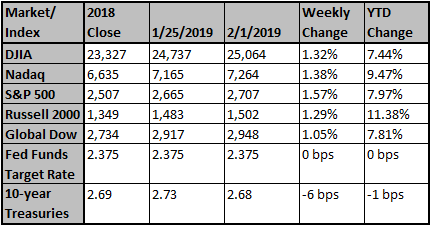

Equities posted the best January results in thirty years; the abrupt reversal of fortune, while perhaps bittersweet, signaled renewed confidence in the economy. For the week the S&P 500® Index rose 1.57%, followed by the Nasdaq (1.38%), Dow Jones Industrial Average (1.32%) and Russell 2000® Index (1.29%). On Wednesday, the Federal Reserve left interest rates unchanged and removed longstanding commentary that further rate increases may be necessary. The Fed also stated that its prima… View More

Today the Federal Reserve Board decided to leave the Federal Funds Rate unchanged. More importantly, they also said that "In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes." After the December meeting (when the Fed raised rates by 0.25%), we shared that we thought Powell's (and the Federal Re… View More

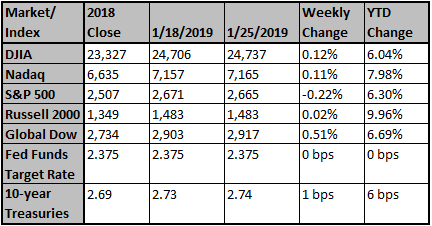

The equity markets ended this holiday-shortened week essentially unchanged. The Dow Jones Industrial Average (+0.12%) and the Nasdaq (+0.11%) led with modest gains followed by the Russell 2000® Index (+0.02%) while the S&P 500® Index fell 0.22%. Shortly before the markets closed on Friday, President Trump announced a deal with lawmakers to approve a bill which would reopen the federal government until February 15th while negotiations continue. State unemployment claims for last week … View More

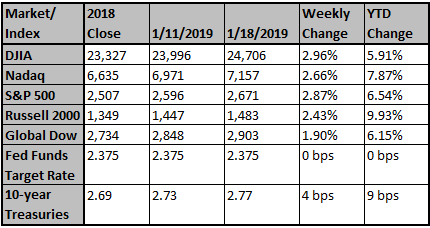

The equity markets recovery continued last week led by a 2.96% gain in the Dow Jones Industrial Average followed by the S&P 500® Index (2.87%), Nasdaq (2.66%) and Russell 2000® Index (2.43%). Corporate earnings season began last week with major financial institutions including Citigroup, JPMorgan, Bank of America, and Goldman Sachs; each posted earnings that exceeded analysts’ expectations despite low trading revenues related to December’s severe volatility. The companies believe t… View More

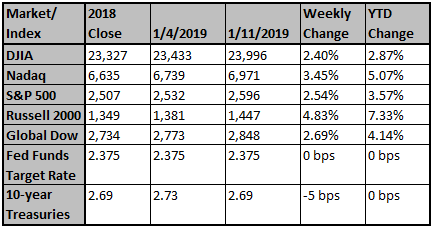

The equity market recovery continued this week as the oil price rebound, Federal Reserve comments regarding ‘patience’ in interest rate policies, and mid-level trade negotiations with China improved investor sentiment. The lack of progress on the government shutdown, which on Saturday will become the longest in history, apparently did not influence market sentiment. Fears of a recession subsided as the Russell 2000® Index led the markets with a 4.83% gain followed by Nasdaq (+3.45%); S… View More