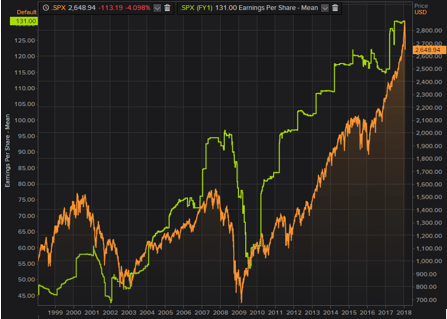

Nine years ago, on March 9, 2009, the stock market bottomed as plans to end overly strict mark-to-market accounting rules took shape. Banks were no longer forced to write-down assets to illiquid, un-traded market prices. Since then, profits have soared as entrepreneurs and innovators have overcome the headwinds of two tax hikes and a rise in regulations. Starting last year, these government-created headwinds began to shift, as deregulation and tax cuts became tailwinds for the economy and the ma… View More

Authors

Post 531 to 540 of 607

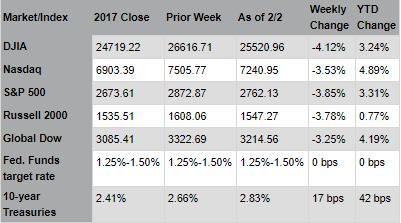

February has kept investors on their toes. Just before the month began, Amazon, Berkshire Hathaway, and JP Morgan Chase announced their entrance into the Healthcare Market. The S&P 500 Healthcare Sector traded down 12% after the news broke. In February, the VIX (volatility measurement) climbed 176% and then fell off sharply to end the month at a more normal level. The S&P 500, Dow Jones, and Nasdaq were all down more than 8% for the month by February 8th, but ended the month down… View More

For the last few years we have been lulled into a false sense of security that no matter what happened in the world, the Market would continue to go straight up. All you needed to do is look at the VIX Index over the last few years to confirm my comments. VIX is the ticker symbol for the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options… View More

While we are unsure of what the next few weeks look like for the stock market as we work through putting in a tradeable low, we feel confident that when the fog clears, the trend will ultimately resume higher. The average S&P 500 decline in midterm election years is 18%. Midterm election sell-offs have proven to be great buying opportunities with stocks up an average of 36% one year later. We are very bullish on the economy, moderately bullish on equities (the economy could outperform the … View More

Markets rebounded Last week on positive economic data and stable interest rates. The CBOE Volatility Index (VIX) fell 33% as a sense of calm followed the recent selloff in stocks. Already, the 10% market correction has been cut in half; the S&P 500? Index ended the week down just 4.9% from its January 26 high. The recent pullback was exacerbated by strategies betting on low volatility; the 250% spike in the VIX triggered trading algorithms to unload stocks. That selling pressure app… View More

Markets recovered somewhat on Friday after a significant selloff last week as all of the major indices briefly entered correction territory (i.e., declines of 10% or more from their most recent highs). Last year US stock markets experienced the least volatile year on record, hitting new highs seemingly every day. Then came the tax reform bill to end 2017, and a huge January with the S&P 500 rising 5.6%. Investors, especially individuals who finally became convinced that the rally would… View More

January was an impressive month to say the least. The return of the S&P 500 was +5.65%, which is the best January since 1997, and the fifth best January since 1980. With the market reaching new highs during this, the second longest bull run on record, many investors are wondering if now is the time to take their gains and get out of the market. The equally strong pullback in the first week of February is adding to some investors’ concern. This month, we want to address this questio… View More

There has been a lot of discussion about the stock market’s losses over the last week, the rise in interest rates, climbing inflation, and of course the “sharp” increase in volatility. We wanted to put these items into historical context. The charts below begin on January 19, 1993. We chose this day because it’s the day the Chicago Board Option Exchange introduced the VIX (the Volatility Index). We have broken down the various data points into multiple charts to make it easier to… View More

Stocks declined across the board last week leaving clients to ask is this still a healthy market? Last week was the first 5% pullback we have seen in the equity markets since January of 2016. A better-than-expected jobs report sent interest rates higher which, in turn, triggered Friday?s sharp selloff; the Dow Jones Industrial Average lost 666 points, a 2.54% decline. The yield on the benchmark 10-year U.S. Treasury Note rose 0.18% this week, to 2.84%, from 2.40% at the end of December and… View More

We know the question many are asking is "Are we at the end of the bull market yet." We don't think so, and wanted to share some facts to support that statement: The Atlanta Fed is now projecting real GDP growth at a 5.4% annual rate in the first quarter, which would be thefastest growth for any quarter since 2003. We think that's on the optimistic side and expect growth at more like a 4.0% annual rate, but, either way, the economy is showing signs of an overdue acceleration and we are now p… View More