There is plenty of weaker global news, including a new lockdown in London this weekend. A package of weaker economic data looks to have finally broken the stalemate on U.S. fiscal policy. Additional stimulus from D.C. appears imminent, sizeable, and front-end loaded for 2021. We’ve revised up our near-term U.S. real GDP estimate, including moving 1Q into positive territory (+3.0% q/q A.R.), and continue to look for an economic surge by mid-2021. The “19” in COVID-19 stands for 2019, marking the origin of the disease. Soon we will turn the calendar to 2021, and the impact should fade as medical solutions (vaccines) to the medical problem (virus) become widely available. Economic re-openings (sustainable) are obviously better than stimulus (temporary), but current efforts are needed to provide a bridge.

Support is needed with U.S. retail sales weaker-than-expected, falling -1.1% m/m in November & downward revisions to prior months. Weekly jobless claims also rose again w/w to 885,000 last week. While the recession appears over for numerous wealthier individuals, those unemployed (which are concentrated at the lower-end of the pay scale), those tied to state & local jobs, and small businesses remain at considerable risk. There has been a lot of contention over the renewed lockdowns with many speaking of the economic damage they are causing.

Near-term U.S. payroll readings could turn negative month over month, but if the income is made up and there is no financial crisis (thank you Fed), then markets can look thru this event. There are issues like unpaid rent that could sum to $70 billion, but vs. a ~$900 billion stimulus, the macro-economy still has support.

The Fed acknowledged last week that the next several months are likely to be tough for the U.S. economy. True, there are areas that are expanding (eg, industrial production up +0.4% m/m in Nov, housing starts up +1.2%). But the service sector remains at risk.

The FOMC is working with its current tools. Credit remains key for a robust recovery, though the Fed cannot provide grants to specific sectors, as Chair Powell noted (reiterating his “lending not spending” comments).

Fed Chairman Powell also was clear that one-time price increases in 2021 on a re-opening (eg, a pop in pentup demand) would not create worry at the Fed about inflation. Inflation would have to be maintained year after year, and show up in wage increases as well. This approach could be tested in 2021.

Sentiment is undoubtedly running hot, and for as fear-driven as March was, the frenzied pace of new IPO’s and the SPAC phenomenon of recent months is quite the 180. None of that is lost on us, and there’s likely some punch in the gut in our future, but it’s just really hard to time corrections in bull markets! Particularly fully-confirmed bull markets – stocks of all sizes, styles, and geographies are working without much discrimination other than relative performance. We joked the other day that we couldn’t remember a time in recent years that both Haliburton and Shopify were breaking out on the same day.

This week also marks 9 months (and a resounding +65%) off the 3/23/2020 low, a rally only rivaled by the first 9 months coming off the August ’82 and March ’09 market lows. In both the ’82 and ’09 examples, the next 9 months were more challenging and more volatile as gains were digested before each advance ultimately resumed. This won’t be a perfect roadmap, but it is something to think about.

Bottom line: the Fed continues to believe the biggest problem for the economy is not interest rates or financial conditions, but health issues. This makes sense. By the second half of 2021, economic re-openings should take over (providing a smoother glide path vs. rolling fiscal cliffs). It’s all about stimulus providing an income bridge, despite new lockdowns, from here to there.

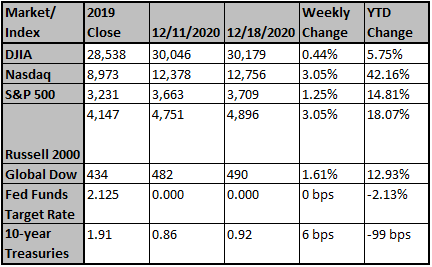

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by FactSet.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Here's a Market Forecast: 2021 Will Be Hard to Predict

At the outset of the coronavirus pandemic, investors and bank strategists put out public prognostications for what would happen in the markets, but 2020's combination was so unusual it wa...

Wall Street Journal

Dec 19, 2020

Stocks drop as new coronavirus strain threatens Britain

Stocks were sharply lower Monday after a new coronavirus strain was discovered to be quickly spreading across Britain and top U.S. lawmakers reached a $900 billion aid agreement.

Fox Business

Dec 21, 2020

Jobless Claims Remain Elevated as Recovery Slows

Nearly 900,000 U.S. workers applied for jobless benefits in a second week of increases, the Labor Department said Thursday, another sign the economy is entering a winter slowdown.

Wall Street Journal

Dec 17, 2020

Facebook and Apple are in a fight. Your browsing history ...

Facebook on Thursday ran its second full-page newspaper advertisement in as many days, attacking Apple's plans to tell iPhone and iPad users when apps are tracking them online.

NBC News

Dec 17, 2020