We wanted to forward out a nice summary of the CARES Act (Covid III Legislation). Please call or email us if you have any questions you would like to discuss regarding the program. Sincerely, Fortem Financialwww.fortemfin.com(760) 206-8500 Latest News CARES ACT - COVID III LEGISLATION Read Story… View More

March 2020

Post 1 to 26 of 26

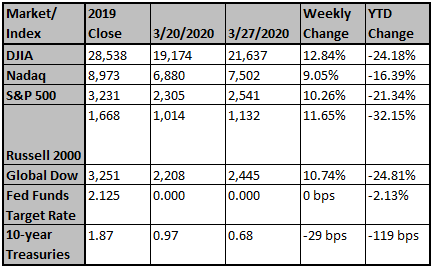

Therapeutic breakthroughs and vaccine tests could bring us relief sooner than later In another volatile week, the equity markets staged a dramatic rally to lessen the impact of this month’s selloff. Expectations for the $2 trillion Coronavirus relief bill, which received bipartisan support in Congress this week and was quickly signed by President Trump on Friday, provided encouragement to investors. The bill provides funding for U.S. individuals and corporations seeking relief for the dramati… View More

Best week for the Dow since the 1930's and making strides on the Coronavirus….From the longest Bull market in history… to a bear market… back to a Bull market… all within 3 weeks...truly historic events are at hand We wanted to drop you a short note after the last few weeks, which have been nothing short of exhausting and nerve racking. After many record down and record up trading sessions, it appears the markets may have finally found an equilibrium on Monday. With our war on this sile… View More

Most of the world is now hunkered down. We’re socially distancing ourselves from each other in the tiny clusters of our nuclear families for an unknown period. The stock market has plunged at a record speed, wiping out gains made since December 2018, and with fears of more selling to come. But there is light at the end of the tunnel as efforts are underway on various fronts, healthcare therapies and Government financial stimulus, that may show us the path forward. And finding that path is the… View More

Although the final text of the stimulus package is not complete yet, there is a senate-produced summary of the legislative compromise (follow link below). It walks though the stimulus package section by section in an easy to read fashion. When the final text becomes available, we will send it out. Sincerely, Fortem Financialwww.fortemfin.com(760) 206-8500 Stimulus Package Senate Summary of Legislative Compromise Read Story … View More

Good morning. The federal government and the Federal Reserve are using their massive balance sheets to fight any significant surge in unemployment stemming from the coronavirus. Policymakers are viewing the fight against the coronavirus as a wartime-like event and they are putting wartime resources behind the effort. Last night, negotiators reached agreement on a roughly $1.8 trillion fiscal stimulus, with most of the tax and spending changes front loaded to cushion the blow from a temporary de… View More

An agreement on the economic stimulus package is a lot closer this morning. Senator Schumer and Treasury Secretary Mnuchin resolved most of the large issues last night. A deal did not materialize yesterday, but negotiators knew the clock was ticking and worked late into the night to get the details in order for a potential deal announcement today. Last night, Mnuchin agreed to more oversight of the corporate loan facility and Schumer won more money for hospitals and $25bn of direct aid for the … View More

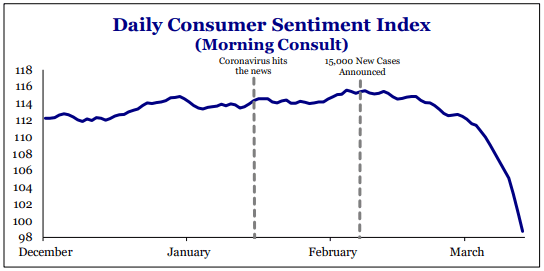

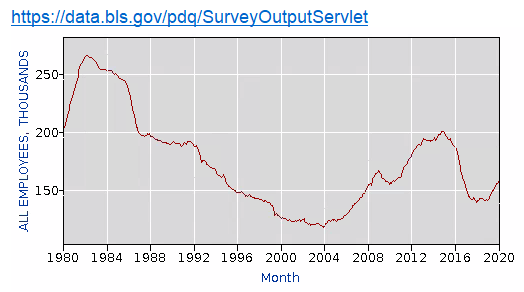

We interrupt your normal viewing pleasure to bring you a special report: Due to fears about the Coronavirus – more specifically, the forceful government measures designed to halt its spread, the US is on the front edge of the sharpest decline in economic activity since the early 20th century. The US economy was on track to grow at around a 3.0% annualized rate in the first quarter before fears and response measures escalated. Don't just take our word for it, the GDP model used by the Federal … View More

Good morning. After last night’s failed Senate vote, we noted suggesting that failure likely needed to happen to move the process forward and that a deal could be announced this morning. Negotiators are not there yet. Following a series of meetings late last night, Senator Schumer remarked at 12:30am that there still was no agreement, negotiators were getting closer, staff would work through the night, and the principals will reconvene in the morning at 9am. The legislation is already weeks b… View More

More than 250 years ago our founding fathers founded this republic to make life better for their fellow citizens. Our constitution starts with the following preamble: “We the people of the United States, in order to form a more perfect union, establish justice, insure domestic tranquility, provide for the common defense, promote the general welfare, and secure the blessings of liberty to ourselves and our posterity, do ordain and establish this Constitution for the United States of America”… View More

Estimates for 2Q GDP growth are ratcheting down and a 10 percent contraction is not far off from the consensus. Initial unemployment claims could reach 1 million next week. If policymakers get this wrong, contagion can easily spread, despite the temporary nature of the coronavirus. In that context, Congress is rushing to get a $1 trillion plus stimulus passed in the coming days. Senate Republicans released their plan last night. There are large differences between the goals of the two parties, b… View More

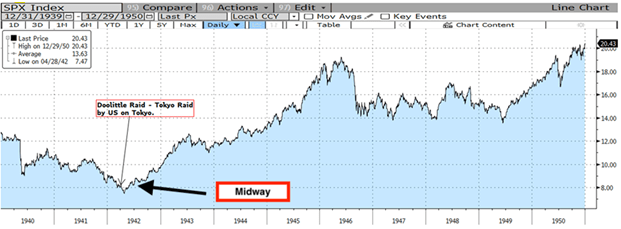

After listening to Governor Newsom’s “stay-in-place” decree last night, we had a lengthy discussion about the impact of a total lock down on California, the market and our expectations for it. During that discussion, we talked about the emotions elicited by both market gains and market selloffs. A key observation was that it easy to buy into a jubilant market, but it can be difficult to remain invested during a significant market draw-down. Below is a chart of the Dow Jones Industrial Ave… View More

We spent last week warning policymakers about the urgency and magnitude of the economic fallout from the coronavirus. To be fair, Congress will always lag market participants, and politics constrains a quick response. But the gap was so wide between financial market participants and policymakers that we were deeply concerned. Exactly one week ago today, the consensus view in Congress was to take a wait-and-see approach. But as we all know, once the slowdown hits the data, we are too late. Financ… View More

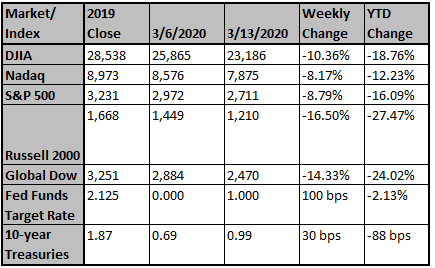

Volatility and uncertainty continues in markets with health conditions from the virus in China improving

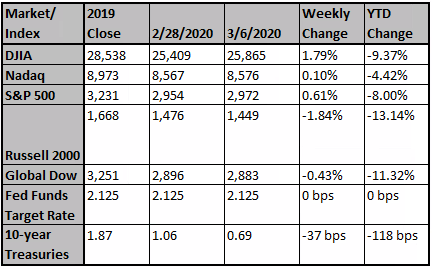

Markets across the globe sold off last week as the coronavirus spread to over 125 countries and oil prices reflected last week’s failed OPEC+ negotiations. The markets gyrated wildly last week: for example, the Dow Jones Industrial average lost 2,013 on Monday, gained 1,167 on Tuesday, lost 1,464 on Wednesday, lost 2,352 on Thursday and ended the week with a 1,985 gain on Friday. Thursday’s selloff was the worst since October, 1987. Last week, all of the major indices entered a bear market (… View More

We wanted to take this opportunity to say thank you for your continued trust in our firm’s Intellectual Capital. Even though we have never been through this type of scenario before, we remain confident that we will get through this and will have a V shaped recovery once we get some clarity on the virus and its effects on the economy in the short-term. We would like to let you know that since the day we founded Fortem, we have built a very robust Technology platform that will allow us to work r… View More

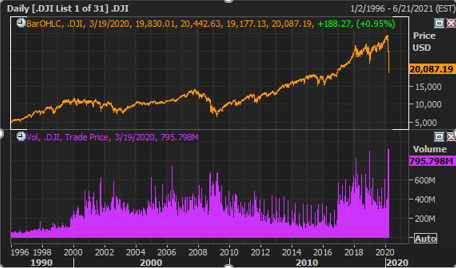

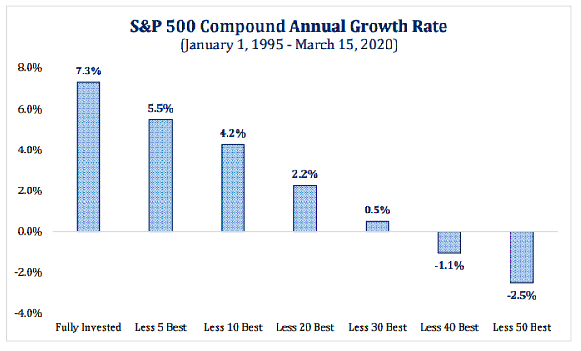

There are a couple of topics we want to discuss this morning; the risk of market timing and the Fed's actions overnight. With respect to market timing, we understand the temptation to try to time the market, but moves like Friday's help demonstrate exactly why we should not. There will be up days and up periods that investors will miss, and missing those periods will have a negative impact on investor returns. In looking at the last 25 years of the market's data, we found that if an investor ha… View More

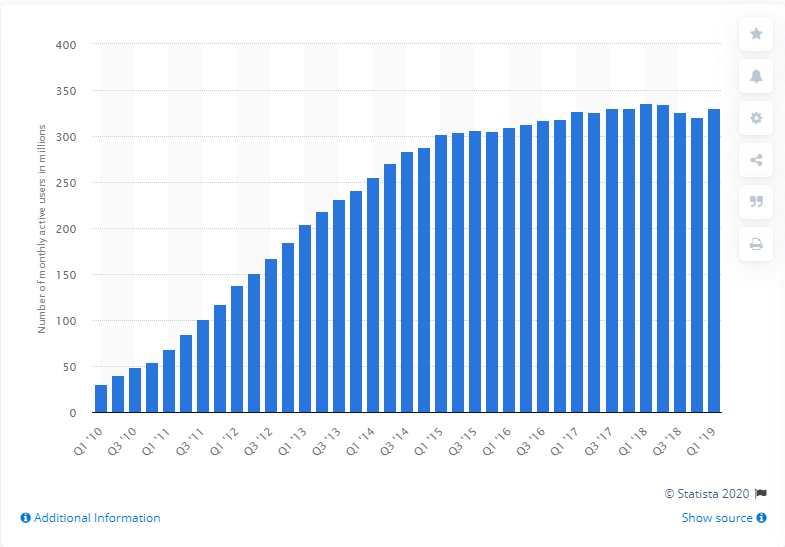

We continue to hear that the world has NEVER known something like the Coronavirus pandemic, so we decided to do some digging to see what we could find. Interestingly, the first thing we came across was the "H1N1" flu virus. You can access the information yourself from the CDC's website following this link if you would like to: https://www.cdc.gov/flu/pandemic-resources/2009-h1n1-pandemic.html We quote from the CDC, "In the spring of 2009, a novel influenza A (H1N1) virus emerged. It was det… View More

Yesterday was a hard day in the market; some may even contend the market has "never been this bad." But that would be our emotions speaking, and it would be factually incorrect. The S&P 500 was down 9.5%, a far cry from the 22.6% it lost on Black Monday - October 19, 1987. We only bring this up because we believe it provides perspective. It is easy to allow ourselves to believe that the current conditions are the WORST that have ever been. Time (and gains) heal old wounds in the market. The… View More

As many of you know, we have been following Bob Doll for over 20 years now. He put together a list of 10 things to consider during this Coronavirus outbreak. We thought it would worth your time to read his comments, which we have copied below. From his comments, we want to point out the underlying strength in the economy. While we will only know the full extent of what the Coronavirus will do after it is done, we do know that the US economy was about as well prepared for this as one could hope. … View More

We understand the level of fear associated with both the Coronavirus and the market's sudden drop over the last few weeks. Further, we understand the feeling that this is a "new" crisis, the likes of which we've never seen before. In reality, Coronavirus is a new crisis, but that was also true of every crisis we have ever seen. We have been doing this a long time, and we have seen many crises come and go, each of them "new" and "unprecedented." In 1997, we faced the ASIAN FINANCIAL CRISIS. Debt… View More

We wanted to share a piece with you that was written by FirstTrust. We think their comments about how various virus's have impacted the markets over the years are worth considering. Please call or email us with any questions. Sincerely, Fortem Financialwww.fortemfin.com(760) 206-8500 Latest News Will We Have a Corona Virus Recession Read Story … View More

Over the last few weeks, we’ve heard the comment a number of times that “the world has never seen something like Coronavirus,” and the reference is in relation to more than just the spread of the virus. The reference has been in relation to the market’s movements and to the economic impact the virus will take on the global economy. The genesis of these comments could be a variety of things. We have seen both record daily losses and record gains in the stock market. We have seen the swif… View More

Last week OPEC and Russia met to discuss cutting oil production by 1.5 million barrels per day; a move in response to slowing demand due to the Coronavirus outbreak in China. Russia decided NOT to participate in the cut, and in response, OPEC has "declared a price war" on Russia and has flooded the market with oil, increasing its production and causing a sharp drop in the price of oil (-30%). Historically, oil has been a proxy for the overall condition of the economy and stock market. This made… View More

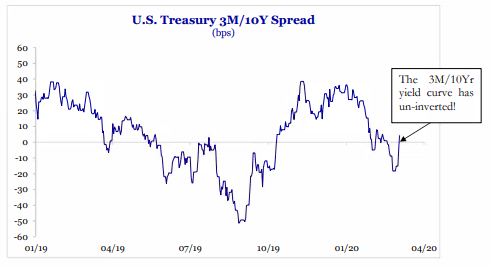

The latest news on the coronavirus and the Super Tuesday primaries caused wild market gyrations last week. Joe Biden’s unexpected primary wins gave him a delegate lead over Bernie Sanders. The coronavirus, however, overtook the Super Tuesday results. China reported a slowing rate of new cases (99 new cases reported on March 6th) for a total of 80,651. Globally, the case count rose to 101,927 with 3,488 deaths. Strategies to contain the virus have led to school closings, work-from-home policies… View More

The Fed decided to make an inter-meeting move and cut rates -50bp today. The size of the move, as well as the emergency decision, fit with a desire to respond forcibly to evolving market conditions. The FOMC statement read “the coronavirus poses evolving risks to economic activity. In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate by 1/2 perce… View More

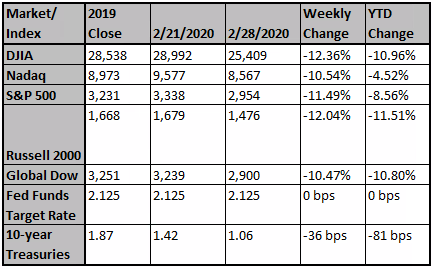

The equity markets tumbled last week on coronavirus fears; despite a late-Friday rally, all of the major indices fell more than 10% last week into correction territory. The worst performer, the Dow Jones Industrial Average, lost a record 3,500+ points (-12.36%), followed by the Russell 2000® Index (-12.04%), the S&P 500® Index (-11.49%) and the Nasdaq (-10.54%). The S&P 500® posted its worst weekly performance since the financial crisis. The decline from the Index’s record high on F… View More