We all have noticed the pickup in market volatility; one could compare it to a game of Dodge Ball. One day the market is up and looks like all is well and the next you have to dodge, duck, dip, dive and dodge again. One of the analysts/portfolio managers we follow is Bob Doll, Senior Portfolio Manager and Chief Equity Strategist at Nuveen asset management. We have followed Bob for more than a decade, and his insights to the markets have been very valuable to us and our clients in the past. �… View More

October 2018

Post 1 to 8 of 8

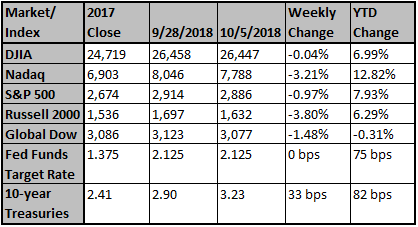

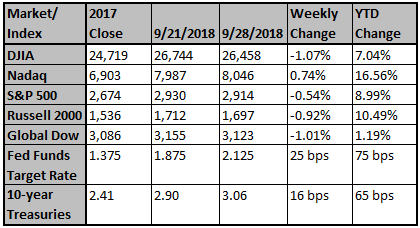

With market volatility like we saw last week, we know everyone is wondering if this is the beginning of a prolonged sell off or even an economic recession. Here are a few key observations we see that lead us to believe this is a pause, and that the stock market is likely to reach higher market highs in the near future. A few bullish points you may find interesting While the cost of credit is getting more expensive, the supply of credit is plentiful and demand is robust. Bear markets typically … View More

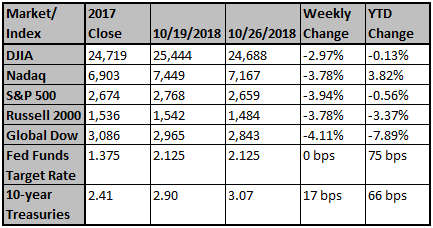

After a big reversal from yesterday’s down opening, stocks recovered quite nicely to close modestly lower. "Stocks ended sharply lower today, as losses accelerated into the close and put both the Dow and the S&P 500 into the red for the year, and the Nasdaq into correction territory. Upbeat results from Boeing Co. were credited with briefly pushing the Dow higher in early morning trading, before investors took an increasingly defensive stance, fleeing for the relative safety of utilit… View More

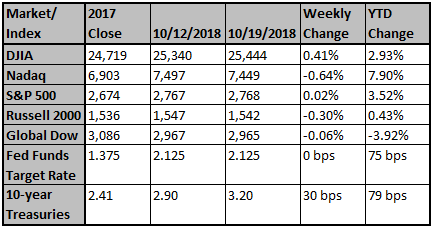

Companies including Adobe, Goldman Sachs, Johnson & Johnson and Procter & Gamble reported strong earnings last week. Notably, Procter & Gamble reported that high demand, rather than price increases, drove its strongest quarterly sales growth in five years. Of the S&P 500® companies which have so far reported earnings, approximately 90% have exceeded analyst estimates. Company commentaries reveal the limited impact of tariffs to date while concerns remain if the impasse con… View More

September and October are traditional the most volatile months of the year. History shows us the largest one day percentage drop in history was 31 years ago, known as Black Monday, on October 19, 1987. On that day, stockbrokers in New York, London, Hong Kong, Berlin, Tokyo and just about any other city with an exchange stared at the figures running across their displays with a growing sense of dread. A financial strut had buckled and the strain brought world markets tumbling down. However, mar… View More

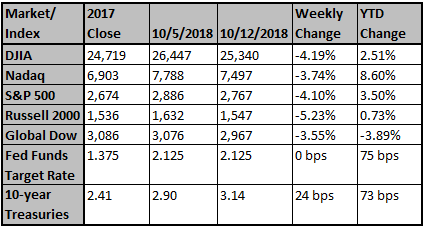

U.S. stocks slumped to close sharply lower today as the Dow Jones Industrial Average sank more than 800 points and the S&P 500 had its worst day since February as technology stocks went into a freefall. Investors were spooked by rising bond yields dumped equities in all sectors, triggering a broad market rout. The Dow Jones Industrial Average DJIA, -3.15% skidded 831.83 points, or 3.2%, to 25,598.74, logging its worst one-day drop since February. The S&P 500 index lost 94.66 points, o… View More

Investors still seem to be underestimating the revitalizing effects of the fiscal stimulus and regulatory easing while overestimating the potential negative impact of a “trade war.” This suggests to us an increase in real GDP, inflation, bond yields, earnings, and stock prices as the year progresses. The pace of stock price appreciation (the multiple), however is likely to slow as the real economy lures liquidity away from financial assets. We continue to have a bias of value over growth and… View More

Just reaching an agreement was the first step. Now the US Trade Promotion Authority (TPA) process will kick in. By the end of 2018, we expect the International Trade Commission to issue a report for Congress detailing the economic impact of the renegotiated NAFTA agreement. The purpose of this report is to be informative for members of Congress before they vote. We have no idea how the report may score the benefits of enhanced intellectual property protection and the new financial services rules… View More