An agreement on the economic stimulus package is a lot closer this morning. Senator Schumer and Treasury Secretary Mnuchin resolved most of the large issues last night. A deal did not materialize yesterday, but negotiators knew the clock was ticking and worked late into the night to get the details in order for a potential deal announcement today. Last night, Mnuchin agreed to more oversight of the corporate loan facility and Schumer won more money for hospitals and $25bn of direct aid for the … View More

Authors

Post 371 to 380 of 609

We interrupt your normal viewing pleasure to bring you a special report: Due to fears about the Coronavirus – more specifically, the forceful government measures designed to halt its spread, the US is on the front edge of the sharpest decline in economic activity since the early 20th century. The US economy was on track to grow at around a 3.0% annualized rate in the first quarter before fears and response measures escalated. Don't just take our word for it, the GDP model used by the Federal … View More

Good morning. After last night’s failed Senate vote, we noted suggesting that failure likely needed to happen to move the process forward and that a deal could be announced this morning. Negotiators are not there yet. Following a series of meetings late last night, Senator Schumer remarked at 12:30am that there still was no agreement, negotiators were getting closer, staff would work through the night, and the principals will reconvene in the morning at 9am. The legislation is already weeks b… View More

More than 250 years ago our founding fathers founded this republic to make life better for their fellow citizens. Our constitution starts with the following preamble: “We the people of the United States, in order to form a more perfect union, establish justice, insure domestic tranquility, provide for the common defense, promote the general welfare, and secure the blessings of liberty to ourselves and our posterity, do ordain and establish this Constitution for the United States of America”… View More

Estimates for 2Q GDP growth are ratcheting down and a 10 percent contraction is not far off from the consensus. Initial unemployment claims could reach 1 million next week. If policymakers get this wrong, contagion can easily spread, despite the temporary nature of the coronavirus. In that context, Congress is rushing to get a $1 trillion plus stimulus passed in the coming days. Senate Republicans released their plan last night. There are large differences between the goals of the two parties, b… View More

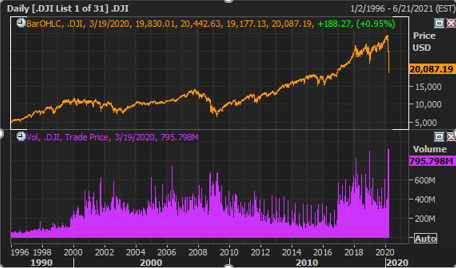

After listening to Governor Newsom’s “stay-in-place” decree last night, we had a lengthy discussion about the impact of a total lock down on California, the market and our expectations for it. During that discussion, we talked about the emotions elicited by both market gains and market selloffs. A key observation was that it easy to buy into a jubilant market, but it can be difficult to remain invested during a significant market draw-down. Below is a chart of the Dow Jones Industrial Ave… View More

We spent last week warning policymakers about the urgency and magnitude of the economic fallout from the coronavirus. To be fair, Congress will always lag market participants, and politics constrains a quick response. But the gap was so wide between financial market participants and policymakers that we were deeply concerned. Exactly one week ago today, the consensus view in Congress was to take a wait-and-see approach. But as we all know, once the slowdown hits the data, we are too late. Financ… View More

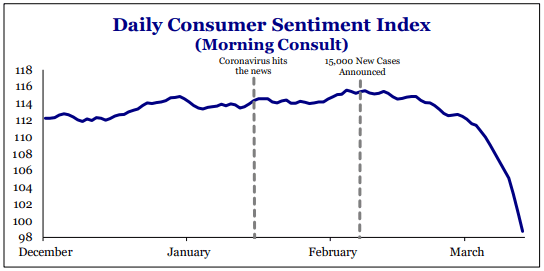

Volatility and uncertainty continues in markets with health conditions from the virus in China improving

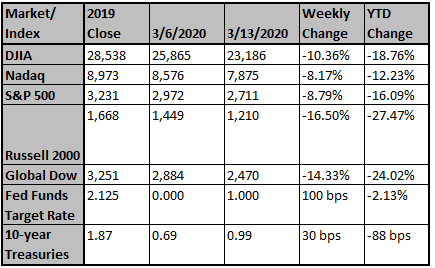

Markets across the globe sold off last week as the coronavirus spread to over 125 countries and oil prices reflected last week’s failed OPEC+ negotiations. The markets gyrated wildly last week: for example, the Dow Jones Industrial average lost 2,013 on Monday, gained 1,167 on Tuesday, lost 1,464 on Wednesday, lost 2,352 on Thursday and ended the week with a 1,985 gain on Friday. Thursday’s selloff was the worst since October, 1987. Last week, all of the major indices entered a bear market (… View More

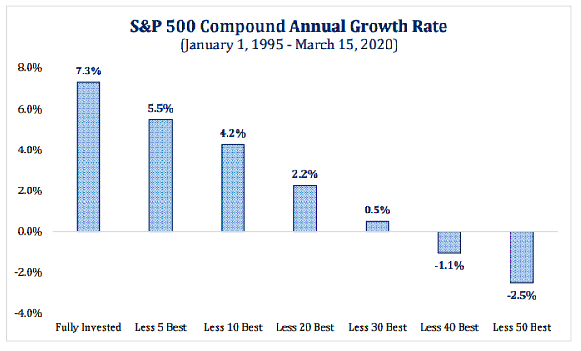

There are a couple of topics we want to discuss this morning; the risk of market timing and the Fed's actions overnight. With respect to market timing, we understand the temptation to try to time the market, but moves like Friday's help demonstrate exactly why we should not. There will be up days and up periods that investors will miss, and missing those periods will have a negative impact on investor returns. In looking at the last 25 years of the market's data, we found that if an investor ha… View More

We wanted to take this opportunity to say thank you for your continued trust in our firm’s Intellectual Capital. Even though we have never been through this type of scenario before, we remain confident that we will get through this and will have a V shaped recovery once we get some clarity on the virus and its effects on the economy in the short-term. We would like to let you know that since the day we founded Fortem, we have built a very robust Technology platform that will allow us to work r… View More