Each year we like to provide you with some insight for the coming year ahead. We like the consistent outlook of one of our favorite portfolio managers/analysts, Bob Doll, from Nuveen asset management. Below is how Bob's predictions are faring so far for 2019. We will bring you his 2020 predictions right after the new year. As 2019 unwinds (and before we unveil Bob’s 2020 Predictions), it’s a good time to look back at the past 12 months and provide initial thoughts about what the next year m… View More

Authors

Post 401 to 410 of 605

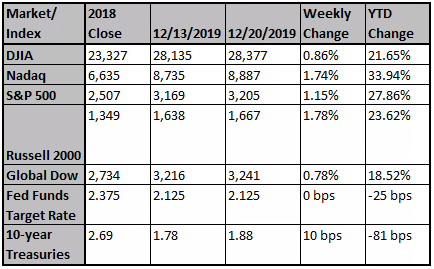

In a quiet, pre-holiday trading week, the major indices continued to move higher on renewed optimism for stronger economic growth in 2020. The Nasdaq (2.18%) outperformed followed by Russell 2000® Index (2.07%), the S&P 500® Index (1.65%) and the Dow Jones Industrial Average (1.14%). The de-escalation of trade wars with the Phase One agreement between the U.S. and China provided this week’s catalyst despite the lack of details on the agreement’s terms. Presidents Trump and Xi spoke on … View More

Congress Passes Sweeping Retirement Legislation, Sends To President's Desk Congress has passed the Setting Every Community Up for Retirement Enhancement or SECURE Act as part of its 2020 spending package — providing advisors, the financial services industry and investors with the most significant piece of retirement legislation in a decade. Currently, 40% of private-sector workers do not have access to a workplace retirement plan. “The SECURE Act will increase workers' access to retirement… View More

As the end of the year and the holiday season approach, we will all see an increase in the number of charitable solicitations arriving in our mailboxes and by email. Since some charities sell their contributor lists to other charities, frequent contributors may find themselves besieged by requests from all sorts of charities with which they are not familiar. Watch Out for Charity Scams – You need to be careful; there are scammers out there pretending to be legitimate charities looking to take… View More

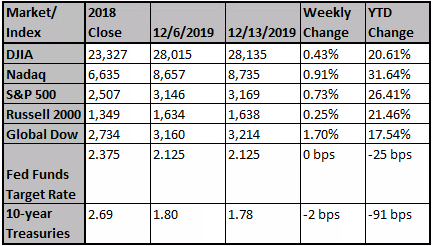

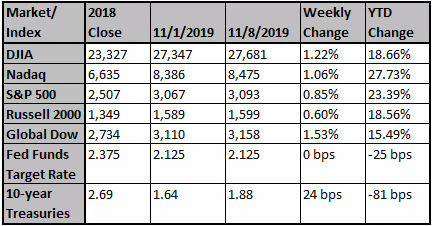

The equity markets ebbed and flowed last week on reports of a Phase One trade agreement between the U.S. and China. On Friday, the White House confirmed earlier rumors of an agreement; the markets’ muted reaction reflects the lack of specifics and modest scope of the deal. More details are coming out today and looks like the markets are welcoming the news. Last week, the Nasdaq (0.91%) led the market gains followed by S&P 500® Index (0.73%), the Dow Jones Industrial Average (0.43%) and Ru… View More

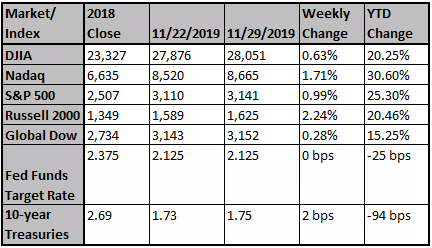

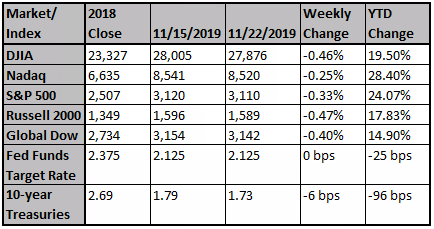

Most of the major indices closed fractionally lower for the week even after Friday’s jobs report, an unexpected gain of 266,000 jobs in November, provided the markets an early holiday gift. The estimates, 187,000 non-payroll jobs would still have been an improvement over Octobers’ upwardly revised 156,000 new hires. The unemployment rate fell to 3.5%, a 50-year low; wages increased 3.1% year-over-year. Also, the Michigan consumer confidence index rose to 99.2 compared to estimates of 97.0. F… View More

The global economic environment seems to be healthier than it was a year ago. Notably, we see evidence of more solid growth around the world, and not just in the U.S. as was the case through much of 2018. The consumer sector in particular has been quite strong and has propelled the broader economy. One year ago, investors were highly worried about a global recession, but those risks appear to have faded. In fact, if anything, we think investors may have grown too optimistic over prospects for s… View More

A number of tactical indicators remain overbought, but the historical data would say that’s actually a good thing. Overbought conditions in uptrends are often consistent with better than average future returns and positive hit rates, and their presence is a common feature in durable market advances. Seasonality can reinforce a trend, and the calendar is clearly a tailwind for performance the final 6 weeks of the year. Following several consecutive weeks of gains, the equity markets lost momen… View More

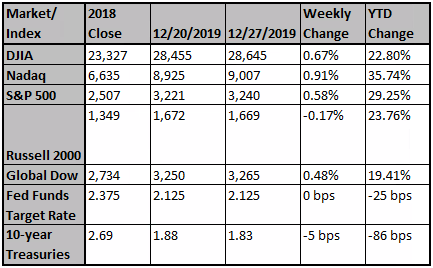

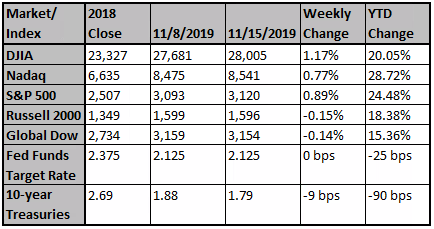

Investors remain at the mercy of trade headlines which are light on substance. The major indices eked out slight gains last week despite contradictory statements on the progress of finalizing the Phase One agreement. The Dow Jones Industrial Average rose 1.17%, followed by the S&P 500® Index (+0.88%), the Nasdaq (+0.77%) and the Russell 2000® Index (-0.15%). Negotiations stalled this week as China stated that it expected a tariff roll back as a condition for an agreement. The U.S. counter… View More

In the stock market, expectations matter. At any given moment, the stock market will reflect a certain set of expectations. And so, what moves markets are changes in those expectations. In other words, news doesn’t have to be good or bad on an absolute basis to move markets. It just has to be relatively better or worse than what was expected. Based on this logic, you can have bad news crossing the wires. But as long as investors and traders were expecting worse, you should in turn expect price… View More