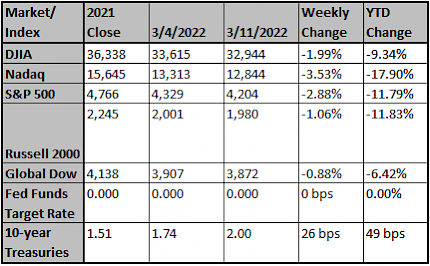

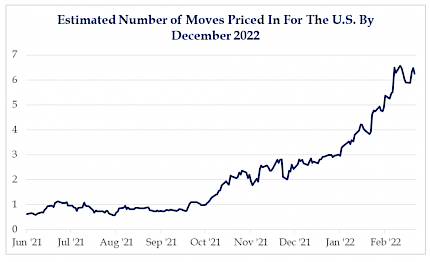

Higher interest rates plus higher commodity prices (energy + metals + food) indicate that we are likely headed for a period of below-trend economic growth. Central banks seem intent on moving to a more neutral policy setting (against the backdrop of continued global supply shocks). The ECB may delay rate hikes, but is looking to accelerate the end of asset purchases. In the U.S., the CPI surged +0.8% month over month and 7.9% year over year in February. The core (ex food & energy) CPI rose… View More

Authors

Post 241 to 250 of 607

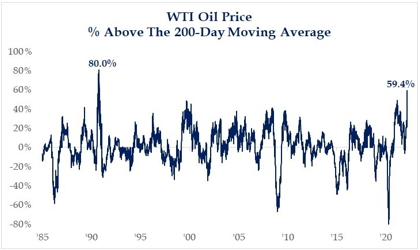

Price Of Oil Most Stretched Since 1990 It’s no secret that the price of oil has skyrocketed over the last week and now stands at roughly 60% above its 200-day moving average. This is the most stretched it has been since the 1990 oil price shock when Iraq invaded Kuwait. During that period, the price of oil more than doubled in 3 months and stayed elevated for nearly six months. 1990 Saw A 20% Correction & A U.S. Recession During the 1990 oil shock, the S&P 500 corrected 20% and th… View More

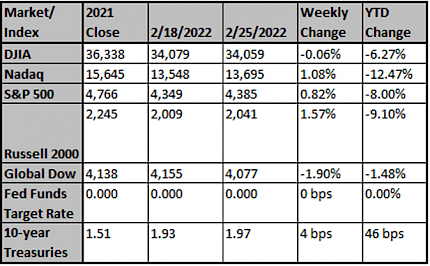

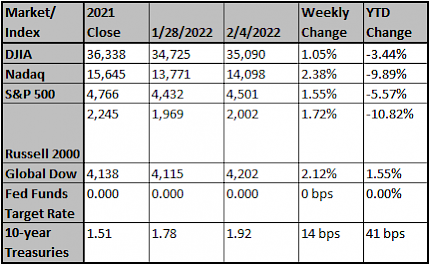

Volatility Picks Up but Markets were higher last week as war breaks out in Ukraine U.S. equities were higher last week (S&P 500 +0.8%) thanks to big rallies on Thursday and Friday after big losses earlier in the week resulting from Russia’s invasion of Ukraine. The rally came as new sanctions on Russia were seen as less severe than expected. Oil prices briefly exceeded $100 per barrel. Best performers included REITs (+2.7%) and utilities (+2.0%); worst performers were consumer discretiona… View More

ANSWERS TO OUR FREQUENTLY ASKED CLIENT QUESTIONS ABOUT RUSSIA 1. With inflation running hot, the Fed likely to tighten, and Russia’s invasion of Ukraine leading to a spike in the price of oil, how worried are you about a recession in the U.S.? We think the chances of a recession are relatively low in the U.S. over the next 12 to 18 months. The labor market is tight, job openings are plentiful, monetary policy remains accommodative, and there remains a large reservoir of personal and corporat… View More

It’s always tempting to prognosticate how a headline event – geopolitical conflict, Fed action, etc. – may change the complexion of the market, but it’s been our experience that exogenous inputs do more to reinforce trends already in place rather than change the game. We’re not sure anyone has a real edge on Russia / Ukraine, and if they did, it doesn’t mean they’ll get the market’s reaction function correct as well. Prior to the acceleration of this conflict over recent weeks, t… View More

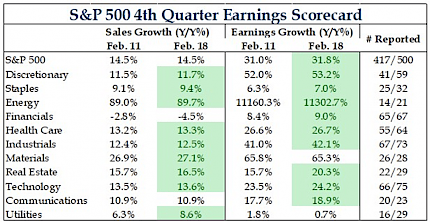

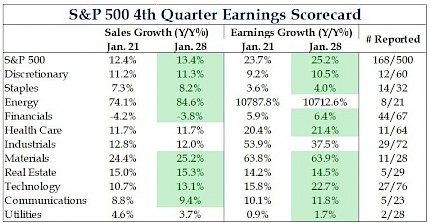

After posting back-to-back weekly gains following the big January sell-off, equities were lower last week (S&P -1.8%). Value and small-cap beat growth and large-cap. Oil was higher for an eighth-straight week. The big story was the January CPI inflation surprise and hawkish Fed commentary. Best sectors were energy (+2.1%) and materials (+1.1%); worst sectors were communication services (-3.9%) and technology (-2.9%). 4Q Earnings Now 70% Reported The fundamental improvement for the aggreg… View More

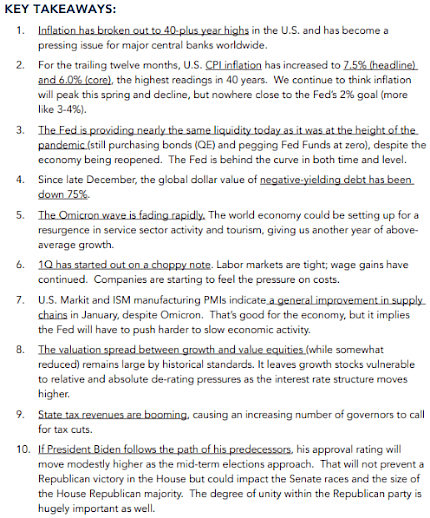

There were plenty of concerns to go around as we finished out the week including: The imminent risk of war between Russia and Ukraine continues to build. The NY Times on February 11th reported US officials have picked up intelligence suggesting Russia may invade Ukraine as early as Wednesday. Further chip shortages may result from a conflict with Russia. The White House warned the US Chip Industry on February 11th that Russia may retaliate against US sanctions by blocking access to key materia… View More

Inflation is starting to be noticed by everyone everywhere. We will not discuss the price of fuel which we expect will be north of $5.00 a gallon in California in the next few weeks. However, we do want to share a recent local “dining” experience. We were out to lunch the other day at a local Mexican restaurant that we have gone to for more than two decades, and we noticed the temporary copied paper menus on the table had replaced the regular menus. I always order the same thing at this plac… View More

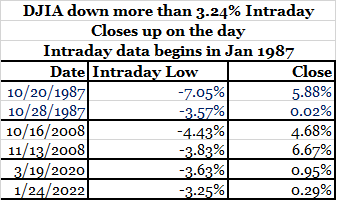

U.S. equities finished last week mostly higher (S&P 500 +0.8%), coming off intraweek lows and rallying strongly on Friday. The S&P 500 moved into double-digit percentage loss territory several times before the end of the week rally. The market reacted negatively to the FOMC meeting, judging that the recent hawkish Fed repricing has more room to run. The Q4 earnings season also continued to prove mediocre, with supply disruptions and cost pressures showing up in too many reports. Best sec… View More

As we have mentioned over the last few months, we expect market volatility to increase in 2022. There are a number of reasons for our concern such as the long running bull market, real Inflation for the first time in more than 20 years and rising interest rates. Maybe our largest concern was the midterm elections while our other concerns are playing out. Midterm elections tend to have larger equity market corrections compared to non-midterm election years with an average intra-year decline of 19… View More