The Dow Jones Industrial Average fell more than 1,000 points last Friday, caused apparently by Fed Chairman Jerome Powell’s attempt to use a brief speech to channel the ghost of Paul Volcker. Obviously, this was part of the market’s worries, but the stage was set when the Biden Administration announced a student loan forgiveness program last week. The more we learn about this, the worse it looks. The executive order would send an already very bad student loan system – a system designed mo… View More

Authors

Post 201 to 210 of 607

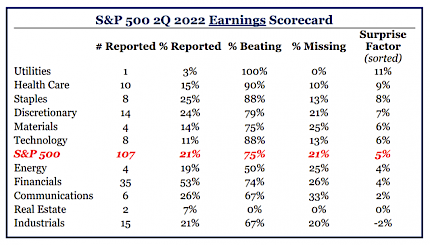

Consistent with the frenetic pace of modern life, a technology-inspired need to achieve instant gratification, and virtually endless amounts of free money, it is difficult for all of us as investors to have the patience to allow economic developments to play out over time. In our defense, who could blame us? Fed tightening in late 2018 led to a brutal sell-off in stocks before Christmas. Two weeks later, Chairman Powell might as well have brought chocolate and flowers to the floor of the New Yor… View More

Equities were sharply lower last week with the S&P -4.0%, its worst week in ten. Friday’s Fed Chair Powell’s Jackson Hole speech was the catalyst for the significant Friday decline as he signaled that the Fed is willing to risk recession to lower inflation. Best performers were energy (+4.3%), materials (-1.3%) and utilities (-2.6%). Worst sectors were technology (-5.6%), communication services (-4.8%) and consumer discretionary (-4.7%). We recognize that we send out a lot of material. … View More

Equities declined last week (S&P 500 -1.2%) with the bulk of the decline coming toward the end of the week. The decline came after four straight weeks of gain. Downside occurred due to Fed commentary indicating determination to fight inflation and therefore more rate increases. Downward earnings revisions and stretched valuations were also of concern. Best sectors were consumer staples (+2.0%), utilities (+1.3%) and energy (+1.3%). Biggest decliners included communication services (-3.3%), m… View More

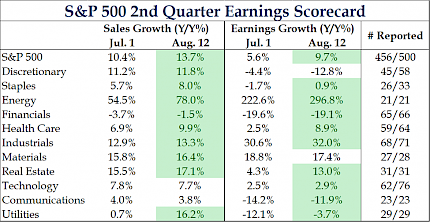

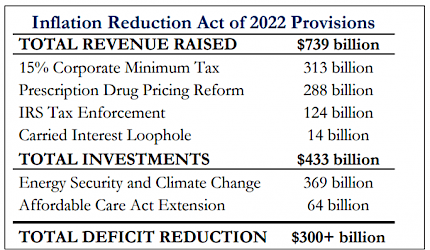

Second Quarter Earnings Better Than Expected In Aggregate… With over 90% of companies reporting earnings for the second quarter, aggregate EPS growth of 9.7% for the S&P 500 is well above the original estimates of 5.6%. The energy sector provided a significant boost; however, 8 of the remaining ten sectors also beat their initial estimates. In addition, revenue growth of 13.7% was also better than expected. …But 2023 Earnings Per Share Estimate Being Revised Lower In our opinion, th… View More

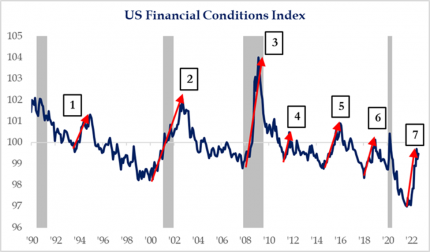

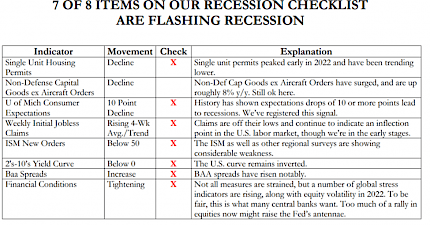

Stocks were mixed last week (S&P 500 +0.4%). The most notable event for the week was the hot jobs report on Friday as the Fed continued to push back talk of a Fed pivot post the turn of the year. Best sectors were technology (+2.0%), consumer discretionary (+1.2%) and communication services (+1.2%); worst sectors were energy (-6.8%), real estate (-1.3%) and materials (-1.3%). At full employment, U.S. job growth should be slowing – we’re still waiting. U.S. nonfarm payrolls surged +528… View More

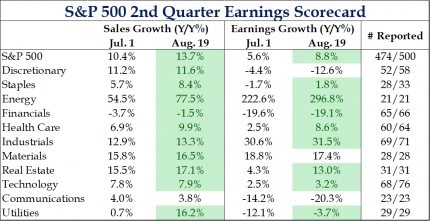

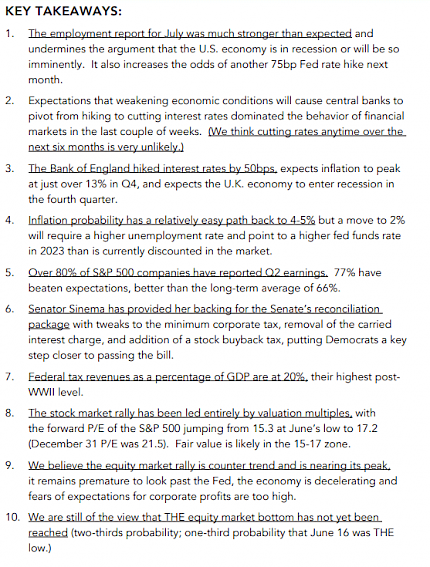

Stocks rallied again last week (S&P 500 +4.3%) for the third week in the past four helped by continued better than feared earnings (especially big technology companies), declines in bond yields, and valuation improvement. Best sectors were energy (+10.4%) and utilities (+6.5%); worst sectors were consumer staples (+1.6%) and healthcare (+2.0%). 2Q Aggregate Earnings & Sales Growth Improving Last week, more than 150 companies reported earnings, and overall results continued to show signs… View More

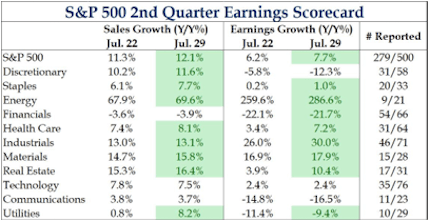

What do you do when you are technically in a recession and inflation is running out of control??? Raise taxes and increase spending on climate change of course! The Gross Domestic Product (GDP) came out at -.90% for Q2 today to confirm our country is technically in recession. The White House is trying to change the definition of recession like it does everything else these days, but the classic definition of a Recession is two quarters of negative GDP. Instead, we are being told we are in a tr… View More

Naturally, during times of market stress, every week seems pivotal. Still, the next five days will be chock-a-block with earnings, economic releases, and economic events that are likely to set the tone for the market and a fair amount of political commentary for the rest of the summer. More than 170 S&P 500 companies will report earnings this week (including 12 Dow components), while 2nd quarter GDP and the Fed’s preferred measure of inflation - the Core PCE- and the ECI will also be annou… View More

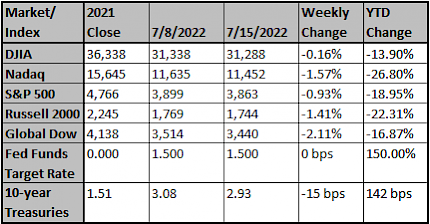

The Treasury yield curve flattened significantly over the course of the week as short-term yields rose and long-term yields dropped while inflation continued to run hotter than expected. The flattening of the yield curve started early in the week as China re-imposed Covid restrictions leading to concerns of additional slowdowns to the world economy. Data released on Wednesday showed the consumer price index increased at a 9.1% year-over-year rate for June, which is the highest annual increase in… View More