US Energy Policy Failure It has been four months since Russia’s invasion of Ukraine. The White House’s failure to recognize that the Russian attack signified a need to focus on energy security over climate change has kept the price of energy elevated, raised recession risks, provided the funding for Putin’s military, reduced support for Ukraine, and eroded backing for Congressional Democrats. Now panic is setting in at the White House as the domestic political environment crumbles and Ru… View More

Authors

Post 221 to 230 of 608

The FOMC raised the fed funds rate +75bp today, taking an aggressive step given the recent inflation & inflation expectations data. The Fed wants a restrictive policy by the end of the year (ie, above a neutral rate that’s believed to be in the mid-2% range) to help restore price stability. The plan is to raise rates (tighten financial conditions) until there’s clear evidence inflation is coming back down. There has been a lack of progress in recent months. The July meeting could see a… View More

All eyes will be on the results of the Federal Reserve meeting today when it announces how much it's going to raise short-term rates, its new projections for the economy and short-term rates for the next few years, as well as Chairman Powell's press conference. After the last meeting in May, Powell made it very clear the Fed anticipated raising rates by half a percentage point (50 basis points, or bps) at each of the next two meetings: this week's event and in July. When asked about a larger ra… View More

As they say, there are two types of economists – those who don’t know and those who don’t know, they don’t know. We’re making educated guesses just like everyone else. But here are some impressions we think are worth considering after Friday’s surprise CPI report and market sell-off: Theoretically, it is difficult to get control of inflation until the Fed Funds rate is above the inflation rate. Using any inflation measure one might choose, the Fed has likely only just begun its tigh… View More

JP Morgan CEO Jamie Dimon caused a stir lately when he talked about a "hurricane" hitting the US economy. We think he may eventually be right, but is way too early. The employment report for May confirmed that the US economy continues to grow. Both major measures of jobs went up in May: nonfarm payrolls rose 390,000, while civilian employment increased 321,000. Total hours worked expanded 0.3%. Has a recession already started? Certainly not. Notably, there is some evidence of a transition in t… View More

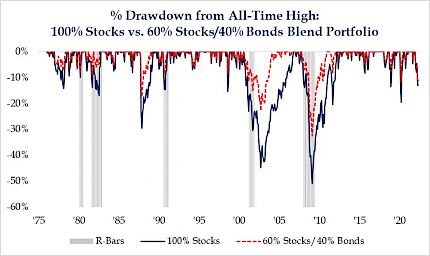

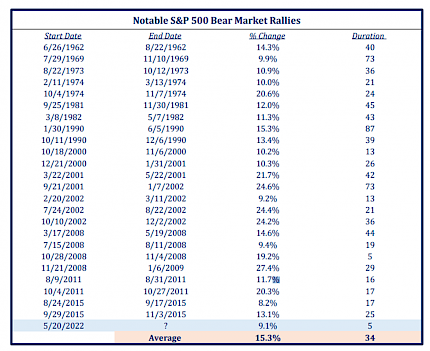

Stocks were sharply higher (S&P 500 +6.6%), breaking the multi-week downward trend. As we covered in recent weeks, stocks rallied on a large oversold condition and extremely negative sentiment. The best sectors were consumer discretionary (+9.3%), energy (+8.2%), technology (+8.1%), and financials (+8.1%); the worst sectors were healthcare (+3.3%) and communication services (+3.6%). What we’ve found notable about the market’s rally over the last week is that it hasn’t put any dent in … View More

U.S. equities fell (-3.0% for the S&P 500) for the seventh straight week. The DJIA fell for the eighth week in a row, the longest losing streak since 1923. The S&P 500 briefly dipped into 20+% decline territory, the traditional definition of a bear market. Multiple bearish themes dominated the dialogue. Three sectors were up for the week: energy (+1.4%), healthcare (+0.9%), and utilities (+0.4%); worst sectors were consumer staples (-8.6%) and consumer discretionary (-7.4%). The Federal… View More

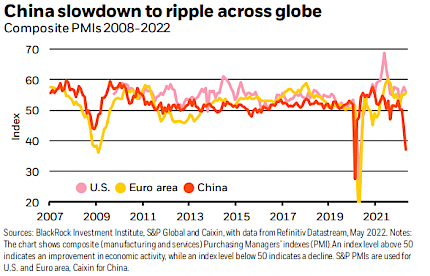

U.S. equities were lower last week (S&P 500 -2.4%) for the sixth straight week (the longest stretch in over ten years). During the midweek selloff, the S&P 500 hit the lowest point since March 2021 and the NASDAQ since November 2020. The bearish case for equities focused on monetary tightening, persistent inflation, China COVID lockdowns, recession fears, and extended valuations. The only positive sector for the week was consumer staples (+0.3%); the worst sectors were REITs (-3.9%) and … View More

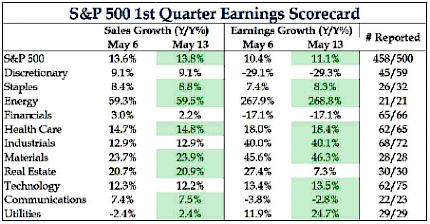

Equities fell last week with the S&P 500 down 0.2%, masking a huge rally on Wednesday and a big decline on Thursday. This was the fifth straight week of equity market decline. Equities fell due to headwinds from a continued back-up in yields (10-year yields were up 24 basis points). Best sectors were energy (+10.2%) and utilities (+1.3%); worst sectors were REITs (-3.8%) and consumer discretionary (-3.4%). 1Q Earnings Season In Line With Historical Average; Outlooks More Worrisome With mo… View More

The vast majority of Strategas’s published research reports can trace their origins to questions from clients we receive when they are on the road. What follows are some simple answers to the questions they are currently getting most frequently. We are happy to hop on a call to discuss them in greater detail should you have further questions about their answers. 1. What is your most non-consensus view? Where do you think the consensus is potentially most offsides? We have a relatively high co… View More